Apr 9 2013

Medusa Mining Limited (¡°Medusa¡± or the ¡°Company¡±), through its Philippines operating company Philsaga Mining Corporation advises that the positive results of its first pass Bananghilig Gold Deposit Scoping Study©ö to ¡¾ 25% accuracy warrant the commencement of a Feasibility Study to be undertaken by external consultants. It is planned to complete the Feasibility Study in the September quarter 2013 which will include financial outcomes.

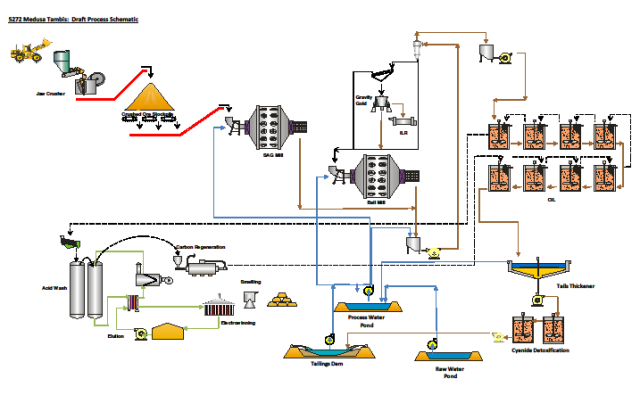

Figure 1. Bananghilig Mill process schematic.

Figure 1. Bananghilig Mill process schematic.

Key Scoping Study Parameters

- Mill size: ~ 5,000,000 tonnes per annum to produce 200,000 annualised ounces

- Initial recovery by CIL at 80% with potential through a plant upgrade to increase to 90% with flotation plus oxidation processing routes.

- CAPEX ¡¾25%: US$220 million comprising:

- Mill: US$170 million

- Associated infrastructure including tailings storage: US$50 million

- Mill OPEX: US$12 per tonne

- Indicative diluted head grade: 1.3 g/t gold

- Indicative mining OPEX: US$15.50 per tonne ore

- Indicative waste to ore strip ratio: 5:1

- Indicative cash costs: US$565 per ounce (including royalties)

Additional information

- Resource update and initial reserve estimations following incorporation of 14 infill drill holes with results published in September quarter 2013

- A second mill site being prepared for sterilisation drilling following the discovery of strong mineralisation at the first site

- Strong community support indicated through comprehensive community consultation

- Application for Environmental Clearance Certificate in preparation

- Feasibility Study to ¡¾15% accuracy by external consultants commenced for completion in the September quarter 2013.

A number of opportunities exist to improve the project economics and extend the mine life through a range of initiatives including resource expansion, mine scheduling, grade optimisation, processing, flow-sheet optimisation and other initiatives to be undertaken in the Feasibility Study. Currently there are no perceived environmental or social impediments for the development of the project.

1 The Bananghilig Gold Deposit Scoping Study is preliminary in nature, and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Scoping Study will be realised.

Background

Arccon (WA) Pty Ltd was requested to undertake Scoping Studies to ¡¾ 25% accuracy on the Bananghilig Gold Deposit to ascertain whether to proceed to Feasibility Studies to ¡¾ 15% accuracy.

The work has involved supervising comprehensive metallurgical test work programmes, developing process flow sheets and preliminary equipment selection, estimating equipment CAPEX costs, as well as CAPEX for tailings storage facilities and associated infrastructure. Mining will be contracted out.

The Bananghilig Deposit currently comprises an Indicated Resource of 11,900,000 tonnes at 1.59 g/t gold for 608,000 ounces and an Inferred Resource of 9,000,000 tonnes at 1.62 g/t gold for 472,000 ounces using a cut-off of 0.8 g/t gold.

Fourteen additional infill drill holes are nearing completion which will be incorporated into the data base and used to estimate a revised resource and the initial reserve which will be published during the September quarter 2013.

Discussion

Geology and Mineralisation

The Bananghilig Deposit currently consists of three zones, each approximately 1 kilometre long and open in all directions, locally termed the Sorex, Garden and Malinao zones. These zones are broadly defined on the basis of the projection in plan of ¡Ã 0.5 g/t gold drill hole intersections.

The mineralisation is located mainly within the Bananghilig diatreme breccia which measures at least 1,000 metres west to east and is still open to the south and east beneath the younger limestone sediments. Additional mineralisation is hosted around the diatreme margins and in the country rocks along structural corridors.

The diatreme breccias contain unsorted fragments of the andesitic basement as well as fragments of the later intrusive rocks predating the diatreme events in a matrix of comminuted rock flour and magmatic crystals. Fragment sizes range from granule-sized to building-sized mega-blocks which have been torn off the walls of the diatreme during the multi-episodal explosive activity. The explosive activity also fractured the mega-blocks and wall rocks, preparing them for subsequent mineralisation deposition.

Additional detailed geological information of the deposit is contained in the announcement of 12 September 2011.

The geology and alteration characteristics of the deposit have been modelled into 10 domains. As a result of the metallurgical work, combined with the domain characterisations, approximately 13.4% by volume of the ore has been identified to contain silicic alteration with subsequent reduced metallurgical recoveries of between 63% to 68%. This ore will be stockpiled for later treatment.

Additional laboratory mineralogical studies are in progress to enhance the understanding of the ore characteristics with respect to the sulphide minerals.

Metallurgical testwork

The flow sheet for the proposed Bananghilig Mill is shown in Figure 1.

The test work campaign indicated:

- the ore is soft to medium hardness and conducive to conventional primary crush and SAG and ball milling;

- the ore is not abrasive;

- optimum CIL leach conditions of:

- 75 micron grind size,

- 0.10% cyanide levels,

- 24 hour leach times,

- a conventional INCO detoxification process is suitable;

- the ore consists of approximately 40% kaolinite, 40% alpha quartz, 5% muscovite and/or illite, and 4% sulphides (primarily pyrite); and

excluding the silicic ore, CIL recoveries of 80% are readily achievable and which can be improved to 90% with the use of flotation plus oxidation processes.

Mining

The estimated mining costs assume:

- the ore is predominantly free dig as observed from geological and geotechnical logging, and verified by the work indices;

- the mining will be undertaken by contractors using 100 tonne trucks and 125 tonne excavators/shovels; and

- the mining benches will be 10 metres.

Power

Discussions with the local power provider to obtain power from the Mindanao grid are planned.

Land access, local relocations and infrastructure

Planning in conjunction with local authorities and residents is well advanced regarding land access, re-location of some local residents and the provision of new housing and services including schools, hospitals, power and domestic water supplies.

Scoping Study exclusions

The Scoping Study excludes:

- project execution/implementation plans;

- project milestone schedules; and

- risk analysis

Scoping Study Recommendations

The Scoping Study key recommendations for the Feasibility Study are:

- identify project risks and impacts, and develop risk mitigation plan;

- develop project execution/implementation plan;

- develop key project milestone schedule project life cycle, such as additional study phase(s), engineering and design, construction and operations phases;

- translate project scoping study concepts into preliminary engineering & design documentation;

- conduct design review for constructability, safety, maintainability, and operability;

- optimise and undertake further engineering study to provide costs validation and improved level of accuracy;

- geotechnical drilling of the site, including diamond core drilling;

- complete in-progress base-line studies;

- complete further environmental geochemical testing to meet permitting requirements (characterisation of mineralised rocks, waste rocks & tailings geochemistry); and

- develop a mine plan using pit optimisation software programmes such as Whittle 4D and include silver as a by-product. The mine plan will generate a mining schedule with varying ore types and gold grades which will be used to generate a plant production profile leading to detailed plant design. Once the mine plan is developed the suitability and representativity of the initial selection of testwork samples will be reviewed.