Energizer Resources Inc. is pleased to update ongoing infrastructure enhancements in proximity to Company's Molo Graphite Project in southern Madagascar.

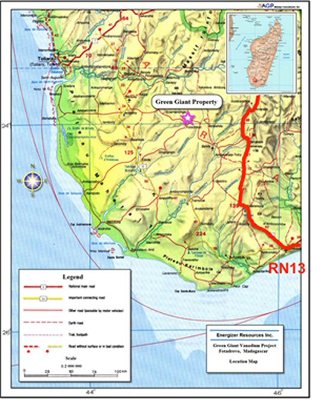

Location of the Molo Graphite Project in relation to RN13.

Location of the Molo Graphite Project in relation to RN13.

Further, the successful elections in late 2013, which lead to formation of Madagascar's new democratically elected government, has resulted in announcements from both the United States and Canada regarding trade relations with Madagascar which will both directly and indirectly have a positive impact on the Company's Project.

Upgrading of Main Arterial Roadway Close to Molo Project

The European Union (EU) has reinstated civil infrastructure development projects in Madagascar, beginning with the allocation of funds for the upgrading of the main arterial roadway, Route Nationale 13 (RN13), which connects the capital city of Antananarivo to the state-of-the-art deep water port of Ehoala in Fort Dauphin, which was constructed for and being utilized by Rio Tinto/QMM's ilmenite sands project in the south eastern region of the country. The upgrade will include critical repairs to the RN13, beginning with the portion closest to the Molo Project and eventually ending at the port.

The road-upgrading project has been awarded to "SARA SRL", a significant and reputable local engineering construction company. Representatives from both SARA and the EU have independently confirmed the allocation of tenders in Madagascar for the rehabilitation of the road between Baraketa, which is located ~30 kilometres immediately east of Energizer's Molo Project, to Antanimora in the south. Both institutions expressed confidence that this first portion of the road upgrade will be completed by December of this year, with the second portion of the works program beginning in early spring of 2015 to extend the road to Ambavombe, where it will intersect with the EU's 2016 program to rehabilitate the third portion, which is the coastal road all the way to Fort Dauphin.

The upgrading of RN13 now positions the Port of Ehoala as a viable alternative for Energizer to consider as a shipping port and this has the potential to positively impact the Company's projected mine economics by reducing overall transportation costs to customer destination.

The Company's Preliminary Economic Assessment (PEA) Study, dated April 12, 2013, considered only the Port of Tulear, located in the southwestern region of Madagascar, and included Energizer bearing the entire cost of maintaining a regional network of gravel roads. The Port of Ehoala in Fort Dauphin offers Energizer the opportunity to utilize a fully developed port infrastructure without the previously envisioned capital and operating restraints considered in the PEA Study. Energizer's EPCM partner, DRA, is now evaluating the new primary port option as part of the Company's soon to be released Full Feasibility Study (FS).

The world-class, multi purpose Port of Ehoala, which was built in partnership with the Madagascar Government, has significant excess capacity and is considered a key structure for the future economic development of the region. The Port is utilized by Rio Tinto/QMM's operations and also accommodates cruise ships, container ships and refrigeration vessels.

President Obama Reinstates Madagascar as Preferred Trade Partner

On June 26, U.S. President Obama reinstated Madagascar to the African Growth and Opportunity Act, or AGOA. The United States' decision to reinstate Madagascar's eligibility as a preferred trading partner is in recognition of the nation's return to democratic rule.

The Act provides free-trade status and other tangible incentives to Madagascar and looks to improve economic relations between the two countries. Madagascar had been an AGOA success story prior to their suspension in 2009. The country exported on average over US$200 million worth of goods a year under the agreement, with a peak of over US$300 million in 2004. The benefits of the AGOA are of critical importance to Madagascar's economy, as it is predicted that the reinstatement could increase exports to the United States by as much as 70 percent and create thousands of local jobs.

This latest proclamation on Madagascar from President Obama is the latest in a string of positive validations from world governments and organizations since the democratic election in January 2014 of the Canadian-trained chartered accountant President, Hery Rajaonarimampianina. Recognition of his commitment and progress to date in rebuilding Madagascar's economy has brought public endorsements of the government by the African Union, the IMF, the EU, the World Bank and the UN's own Secretary-General, Ban Ki-moon.

Canadian Government Identifies Madagascar as "Priority Market" in Global Markets Action Plan

The Government of Canada has officially engaged Madagascar's new government to rebuild economic and strategic resource ties. This past June, Canada's Department of Foreign Affairs, Trade and Development sent Canada's trade Minister to meet with Madagascar's Prime Minister and its Minister of strategic resources and stated that, "Canada welcomes the commitment to work toward the signing and ratification of the Canada-Madagascar Foreign Investment Promotion and Protection Agreement."

Madagascar is identified as a priority market in the Canadian government's Global Markets Action Plan. Andrew McAlister, Canada's ambassador to Madagascar from 2005 to 2007, stated that the two countries are eagerly working towards an agreement to prevent double taxation of corporations working in both regions in the mining, textile and agricultural industries.

A spokesperson from Canada's Department of Natural Resources said that two-way trade between Canada and Madagascar is "moderate", however Canadian investments in the mining sector in Madagascar are significant. Both Sheritt International's $8 billion Ambatovy Project and Energizer Resources' Molo Graphite Project were cited as the most notable mining operations in the country.

Sagar Property Agreement Amendment

Energizer also wishes to announce that it has modified the terms of the Sagar property agreement with Honey Badger Exploration (Honey Badger). Under the new terms of the agreement, in order to acquire an initial 35% interest in the property, Energizer will receive $150,000 and Honey Badger will spend $1,500,000 on developing the property. Honey Badger can earn further percentage interests up to 75% over a four year period by spending a total of $9,000,000 on the property, paying Energizer $900,000 in cash and issuing to Energizer the lesser of 15% of its issued and outstanding shares or 35,000,000 shares. Once these commitments have been met, Honey Badger can earn the remaining un-owned interest of 25% by paying Energizer an additional $2,000,000 and issuing the lesser of 19.5% of Honey Badger's outstanding shares or up to 60,000,000 shares.