GoldQuest Mining Corp. is pleased to announce that the Company has been granted the 550 hectare Los Lechones exploration concession adjacent to its Romero Project in the Dominican Republic.

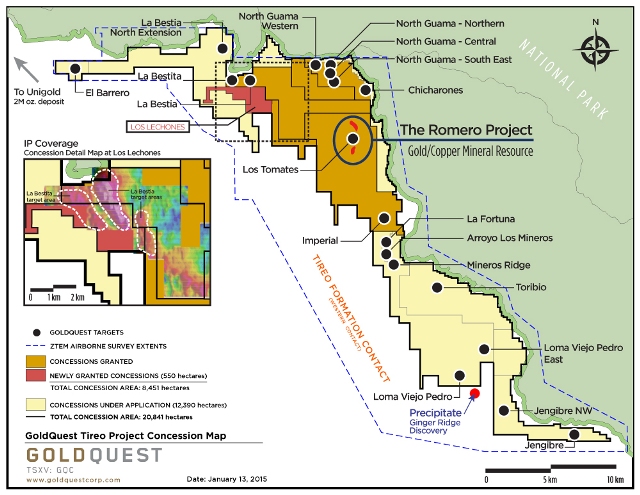

GoldQuest Tireo Project Concession Map (January 13, 2015)

GoldQuest Tireo Project Concession Map (January 13, 2015)

This is in addition to the granting of two concessions, totaling 1,151 hectares, announced earlier this month (see the Company's January 6th, 2015 news release).

"We are now in a position to drill all of the La Bestia targets, where recent mapping has identified significant alteration and geochemical anomalies," commented Julio Espaillat, GoldQuest's CEO, "The Company's geologists are preparing drilling locations for the 2015 drilling campaign."

The Los Lechones and adjacent Los Gajitos concessions cover the south-eastern extension of La Bestia, (see map http://www.goldquestcorp.com/images/maps/GQC-TireoConcessions_JAN132015.pdf) where drilling, conducted in the fourth quarter of 2014, is interpreted to have discovered the peripheral part of a hydrothermal system, where any potentially economic metals may have been precipitated either below or adjacent to the area drilled. Argilllic and vuggy quartz alteration has been identified in dacite in a setting similar to Romero. The geophysical anomaly at La Bestia is 2.6 square kilometres and has a chargeability peak of 13.2 mV/V. For reference, Romero has an anomaly of 1.5 square kilometres and a chargeability peak of 12.7 mV/V. Drilling on La Bestia, and the adjacent La Bestita targets will commence shortly, along with drilling at Imperial, a target south and along trend from the Romero Project.

GoldQuest is actively exploring the favorable Tireo Formation which hosts the Romero deposit discovered in May 2012, resulting in a NI 43-101 compliant mineral resource estimate (see the Company's October 29, 2013 news release for further information regarding the mineral resource estimate), followed by a Preliminary Economic Assessment (the "PEA") showing a 15 year mine life with a pre-tax Net Present Value (8% discount rate) of $318 million (after tax $176 million), pre-tax Internal Rate of Return of 19.7% (after tax 15.1%) and all in sustaining operating costs (AISC) net of by-products of $353/ ounce of gold (see the Company's May 27, 2014 news release for further information regarding the PEA). The PEA is preliminary in nature, 20% of the mine plan consists of inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the results of the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.