Mar 1 2019

Evrim Resources Corp. takes pleasure in announcing that it has started a drilling program at the Sarape epithermal gold-silver project in northern Sonora, Mexico. For this program, 2500 m of diamond drilling has been planned by Evrim along with its exploration partner, a subsidiary of Coeur Mining, Inc., to explore the two chief targets.

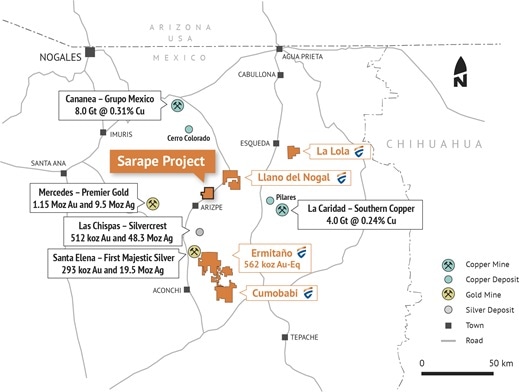

Location of Sarape epithermal project. (Image credit: Evrim Resources Corporation)

Location of Sarape epithermal project. (Image credit: Evrim Resources Corporation)

The undrilled Sarape Project is located in the Rio Sonora Valley, an emerging precious metals mining district that includes Silvercrest’s Las Chispas deposit, Premier Gold’s Mercedes Mine, and First Majestic’s Santa Elena Mine and Ermitaño deposit. Drilling is planned to test the Sarape and Chiltepin veins; targets that have potential for significant gold-silver shoots beneath zones of favourable geochemistry.

Stewart Harris, Vice President, Technical Services, Evrim Resources Corp.

About the Sarape Project

The 5349-ha Sarape epithermal gold-silver project is situated near good infrastructure such as power access and roads. The project comprises of the Sarape Vein, a 6-km-long vein scaling up to 12 m wide, and the Chiltepin Vein, a 2.6-km-long vein scaling up to 3 m wide.

In 2018, work such as sampling, detailed mapping of the veins and surrounding area, and an airborne magnetic and radiometric survey was completed. As shown by structured channel sampling, the western portion of the two veins includes unproductive white quartz and calcite that are understood to be a late, shallow part of the system. The Sarape vein’s eastern portion includes a separate phase of low-temperature, tan green quartz that grades between 0.10 and 3.63 g/t gold and distinctive samples at the Chiltepin vein analysis from trace amounts to 3.66 g/t gold.

Transaction Terms

An 80% interest can be earned by Coeur from the Sarape project through cash payments of US$2.55 million, completion of an NI 43-101 feasibility study within 10 years, and exploration expenditures of US$16.5 million. An initial 51% (the “Initial Interest”) can be earned by Coeur through completion of the annual earn-in commitments and an NI 43-101 preliminary economic analysis (PEA) on a least inferred resource of 1,000,000 ounces of gold equivalent. Once its earns the Initial Interest, an additional 39% interest (the “Second Interest”) can be earned by Coeur through completion of an NI 43-101-compliant feasibility study on a least measured and indicated resource of 1,000,000 ounces of gold equivalent and scheduled cash payments and minimum exploration expenditures until the completion of the feasibility study.

Coeur, after earning the Second Interest, will continue to pay US$100,000 each year to Evrim, until construction and mining permits are received. Immediately after receiving the permits, Evrim may opt to take part in the joint venture with a 20% interest or convert its 20% interest into a 3% net smelter royalty (NSR), one-third of which can be acquired for US$2.0 million.

If Coeur does not opt to continue with the Second Interest, it will convert its 51% interest into a 2% NSR, one-half of which can be acquired for US$2.0 million by Evrim.

The project will be the under control of Evrim until the completion of the PEA, following which Coeur will take the control.