Jul 17 2020

Midland Exploration Inc. reports that a drilling campaign has been initiated on its Samson gold project.

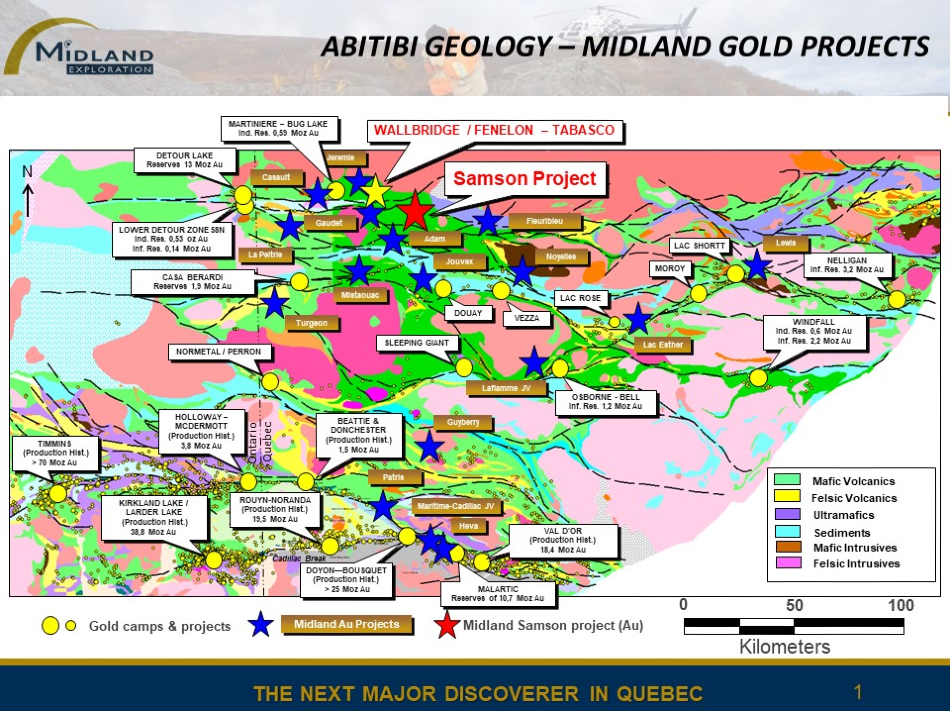

Midland Projects Abitibi. Image Credit: Midland Exploration.

Midland Projects Abitibi. Image Credit: Midland Exploration.

Wholly owned by Midland Exploration, the Samson gold project is situated about 15 km southeast of the Fenelon and Tabasco deposits owned by Wallbridge Mining Company Ltd.

The Samson property contains a total of 304 claims (168 km2) and spans, across a distance of over 15 km, a range of subsidiary structures detected in the initial 5 km south of the regional Lower Detour Fault.

In December 2019, Wallbridge Mining Company announced drill intercepts on Fenelon, or the Tabasco zone, grading up to 22.73 g/t gold (Au) across 48.01 m. Recently, the discovery of the Reaper showing produced high-grade gold intercepts, reaching 308 g/t Au across 2.97 m, such as 858 g/t Au across 1.06 m south of area 51.

Cautionary Statement

Mineralization that occurs on the Fenelon property (Area 51, Tabasco, and Reaper zones) and owned by Wallbridge Mining Company is not essentially indicative of mineralization that may be detected on the Samson property owned by Midland Exploration and is situated close to the southeast.

New High-Priority Drilling Target South of the Lower Detour Fault

Midland Exploration conducted a multi-separation induced polarization (IP) survey in the east section of the Samson property in December 2019 to examine a folded magnetic structure considered to be situated along a subsidiary fault to the south and close to the Lower Detour Fault.

The IP survey results revealed a pair of subparallel axes with chargeability highs ranging from weak to moderate, and also a region measuring about 400 m in diameter, where chargeability values are considerably higher, and situated directly in the nose of the folded magnetic structure.

This latest drilling program includes four drill holes that total 1000 m and has been specifically developed to test chargeability IP anomalies situated in the core of the folded magnetic structure and related to resistivity lows.

In addition, the drilling program involves two drill holes targeting chargeability anomalies that intersect with resistivity highs situated directly to the east of the fold nose.

Since 2009, Midland Exploration has been one of the most aggressive mineral exploration firms to take a strategic place in the Detour belt and has built an extraordinary portfolio of seven high-quality gold properties that presently total 1491 claims (820 km2).

Such land positions offer Midland Exploration a strong position on the prominent Sunday Lake and Lower Detour faults and/or its subsidiaries, across an overall combined distance of over 85 km, together with the lateral extensions of the Detour Lake mine and the latest gold discoveries in Martiniere-Bug Lake, Area 51-Fenelon, and Zone 58N.

Recently, Midland Exploration had optioned its Casault to Wallbridge Mining Company Ltd. The property is situated along the Sunday Lake Fault, about 15 km west of the Fenelon deposit.

The health and safety of our workers and contractors comes first, and we are taking the necessary precautions to prevent the spread of COVID-19, by complying with health and safety measures recommended by Public Health officials, and INSPQ and CNESST regulations governing the reopening of mineral exploration activities in Quebec.

Midland Exploration Inc.

Mines and Deposits Located Near Midland Projects in the Detour belt

Detour Lake mine (Owned by Kirkland Lake Gold—Information from Kirkland Lake Gold website): A total of 12.64 million ounces of gold is present in the Detour Lake open pit mine in proven and probable mineral reserves containing 397.7 million tons grading 0.99 g/t Au (as at December 31st, 2019).

Zone 58N (Owned by Kirkland Lake Gold—Information from Kirkland Lake Gold website): The Zone 58N deposit hosts 0.97 million tons in inferred resources at a grade of 4.35 g/t Au (136,100 oz Au) and 2.87 million tons in indicated resources at a grade of 5.8 g/t Au (534,300 oz Au).

Fenelon (Owned by Wallbridge Mining Company—Information from Wallbridge website): Bulk sampling conducted in 2018 and 2019 yielded 33,233 tons at 18.49 g/t Au.

Martiniere/Bug Lake (Owned by Wallbridge Mining Company—Information from Wallbridge website): The deposit hosts underground indicated resources totaling 1,092,000 tons at a grade of 4.54 g/t Au (159,000 oz Au) and pit-constrained indicated resources totaling 6,827,000 tons at a grade of 1.96 g/t Au (431,000 oz Au).