Sep 1 2020

Latin Metals Inc., a mineral exploration company, reports acquisition of the Auquis copper property situated in the Peruvian Coastal Copper Belt, as shown in the following image.

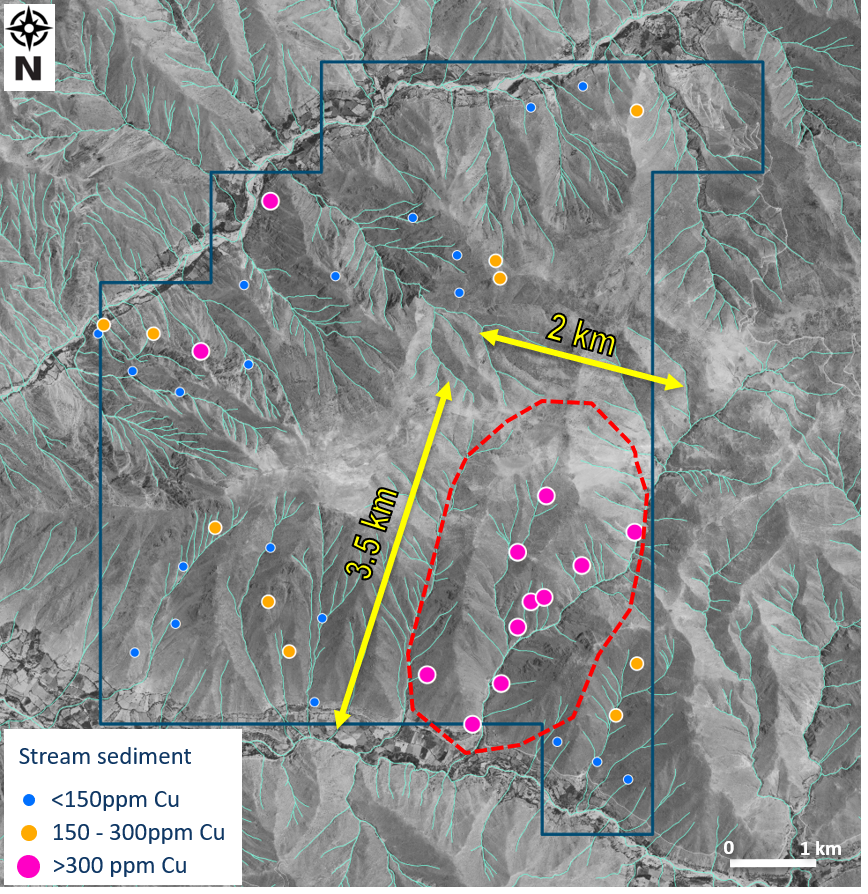

Map of the Auquis copper project, showing historical copper geochemistry results for sediment sampling, which defines a target area approximately 3.5 km by 2.0 km in area. Image Credit: Latin Metals Inc.

Map of the Auquis copper project, showing historical copper geochemistry results for sediment sampling, which defines a target area approximately 3.5 km by 2.0 km in area. Image Credit: Latin Metals Inc.

Latin Metals is a prospect generator, and as such, it already holds a range of projects located in Argentina and has been intensively looking for ways to procure precious metal and copper projects located in Peru.

Recently, Latin Metals had declared that it has also staked a total of 4000 ha Lacsha copper project and is now happy to add the 2900 ha Auquis copper project to the range of projects in Peru.

The Auquis copper project and the earlier announced Lacsha projects are situated inside the Coastal Copper Belt, in which the latest discoveries include IOCG, VMS, copper porphyry, and intrusion-related gold deposits.

Peru’s Coastal Copper Belt has been a focal point for discoveries across the past 15 years. But most of the exploration measures have been targeted at southern Peru, and as a result, most of the northern and central parts of the belt were not explored considerably.

Auquis Copper Project

The Auquis copper project is situated about 377 km south by road from Lima, 95 km from the coast, and can be accessed throughout the year by the paved road.

The Auquis is a copper-molybdenum porphyry exploration project containing numerous untested geochemical stream sediment anomalies, such as a single target area measuring 3.5 km x 2.0 km, in which all stream sediment samples grade more than 300 ppm copper. In total, 42 historical stream sediment samples included multi-element anomalies over numerous drainages, with copper assay results varying from 48.7 to 607 ppm.

The stream sediment data over the survey region revealed a clearly defined metal zonation, with a central core of copper-molybdenum anomalies as well as zinc-lead and distal silver anomalies to the northeast.

Future Work

Latin Metals intends to finish geological mapping along with surface geochemistry in the third quarter of 2020. Budgeted work involves rock chip sampling, lithological and structural geological mapping, and stream sediment sampling.

Technical Advisor

Latin Metals also reported that it has hired Daniel MacNeil as a technical advisor. MacNeil specializes in base and precious metals and has over 19 years of experience from continental-scale project generation to in-mine resource expansion in an extensive range of geological settings across Europe and the Americas.

At present, MacNeil consults with private, mid-tier, and junior mining/exploration firms relating to mine resource expansion and early through drill testing, advanced exploration target delineation, and exploration property assessments worldwide.

Stock Option Grant

Latin Metals also declared that it has granted 70,000 common share stock options (each an “Option) to its numerous consultants and employees and also to its affiliates. The Options empower the holder to buy shares at a price of $0.14 for each share for 36 months from the date of issue.

About Peru

Peru’s mining and extractive industries account for around 15% of its GDP and the country is a considerable producer of both precious and base metals. In terms of global production, the country is ranked #7 in gold production and #2 in copper production.

At present, politics in Peru is controlled by democratic center-right policy and the government recognizes the significance of mining to the national economy. In addition, regulatory framework and Mining law in the country are well-established and the nation is competitive with regard to power and labor charges.

According to the 2019 results from the Fraser Institute Annual Survey of Mining Companies, Peru is the second most appealing jurisdiction in the Caribbean and Latin America.