Mar 29 2021

Puma Exploration, a Canadian-based mineral exploration company, has announced two more property transactions at its Williams Brook property.

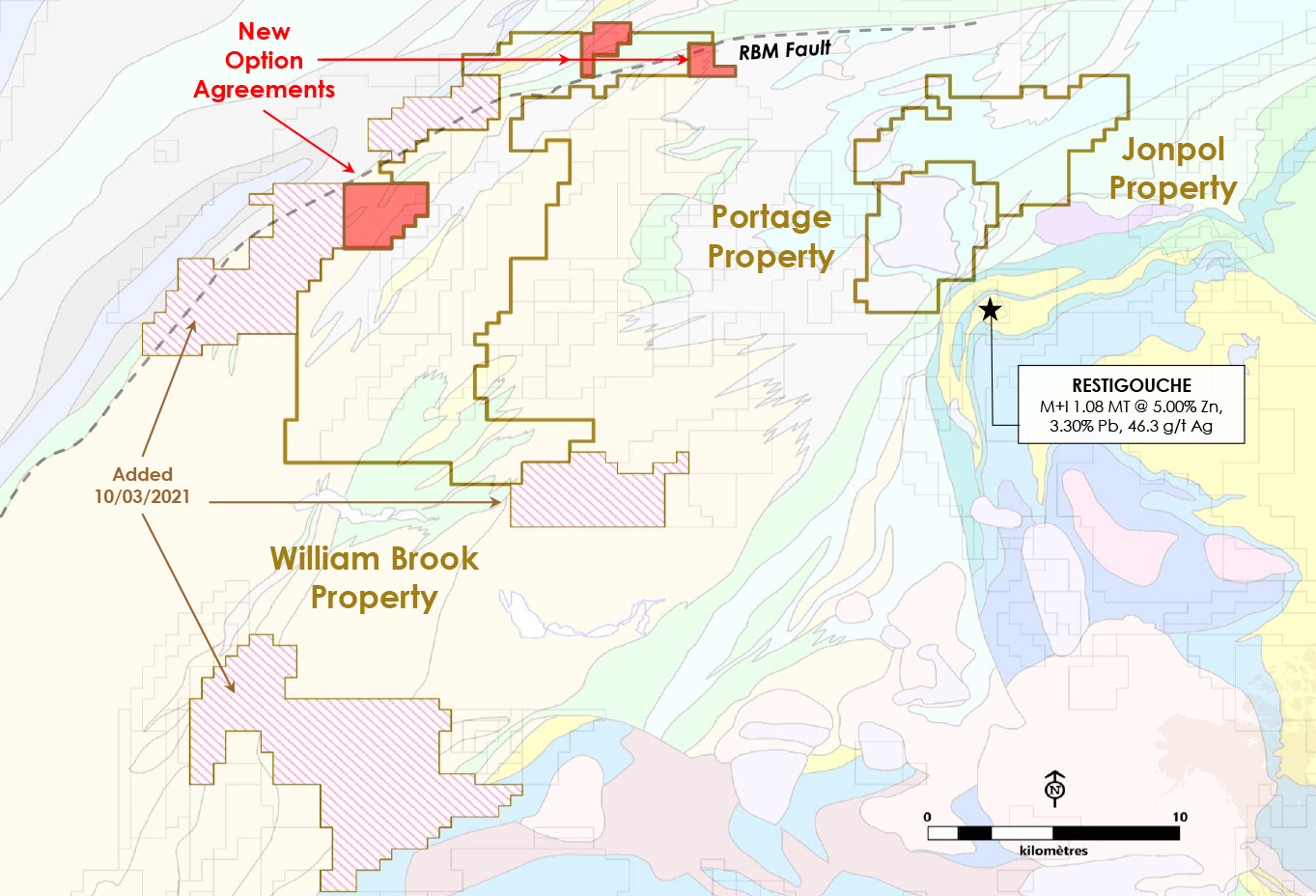

Williams Brook Property Claims Map. Image Credit: Puma Exploration.

Williams Brook Property Claims Map. Image Credit: Puma Exploration.

The acquisitions of these properties add a total of 60 claims to the overall land package, expanding the property size from 23,770 ha to 25,140 ha. The Williams Brook Gold property is part of the district-scale Triple Fault Gold Project, which was recently procured in 2020 in New Brunswick, Canada.

The Williams Brook Gold property was the focus of the 2020 Exploration Program.

These new land additions further consolidate our considerable ground position, increasing our overall footprint to more than 251 square kilometers which cover the highly prospective and underexplored Williams Brook property, but most importantly the major Rocky-Brook-Millstream Fault.

Marcel Robillard, President and CEO, Puma Exploration

Option and Purchase Agreements

To conclude its notable landholdings at the Williams Brook property, Puma Exploration carried out two more distinct property deals with local prospectors for the Northwest Upsalquitch property and the Ten Miles Pool Road property.

Totaling 60 claims units, the new properties are situated north of the Williams Brook property.

Terms of the Ten Miles Pool Road Agreement

Puma Exploration may procure a 100% undivided ownership interest in the Ten Miles Pool Road Property, which includes a total of 36 claim units, by issuing an overall amount of 300,000 Puma shares as per the following terms:

- Issuing an amount of 150,000 Puma shares following the signing of the agreement

- Issuing an amount of 25,000 Puma shares on or before the first anniversary

- Issuing an amount of 50,000 Puma shares on or before the second anniversary

- Issuing an amount of 75,000 Puma shares on or before the third anniversary

Additional Performance Payments

- The owner will receive a cash payment of $25,000 upon a positive preliminary economic assessment (preliminary economic assessment to be defined in the definitive contract)

- The owner will receive a cash payment of $50,000 upon a positive feasibility study (feasibility study to be defined in the definitive contract)

- The owner will receive a one-time cash payment of $100,000 following a commercial production (commercial production to be defined in the definitive contract)

A 2% net smelter return royalty on any commercial production from the property will be retained by the owner. Puma Exploration may purchase 50% of the NSR royalty (that is, 1%) for $1 million.

The company will retain a right of first refusal on the remaining 1% NSR royalty held by the owner. The deal is subject to the approval of the TSX Venture Exchange.

Terms of the Northwest Upsalquitch Agreement

Puma Exploration may procure a 100% undivided ownership interest in the Northwest Upsalquitch Property, which includes a total of 24 claim units, by issuing an overall amount of 200,000 Puma shares as per the following terms:

- Issuing an amount of 75,000 Puma shares following the signing of the agreement

- Issuing an amount of 50,000 Puma shares on or before the first anniversary

- Issuing an amount of 50,000 Puma shares on or before the second anniversary

- Issuing an amount of 25,000 Puma shares on or before the third anniversary

Additional Performance Payments

- The owner will receive a cash payment of $25,000 upon a positive preliminary economic assessment (preliminary economic assessment to be defined in the definitive contract)

- The owner will receive a cash payment of $50,000 upon a positive feasibility study (feasibility study to be defined in the definitive contract)

- The owner will receive a one-time cash payment of $100,000 following a commercial production (commercial production to be defined in the definitive contract)

A 2% net smelter return royalty on any commercial production from the property will be retained by the owner. Puma Exploration may purchase 50% of the NSR royalty (that is, 1%) for $1 million. The company will retain a right of first refusal on the remaining 1% NSR royalty held by the owner.

The deal is subject to the approval of the TSX Venture Exchange.

Triple Fault Gold Project

The Triple Fault Gold Project comprises three properties, called Portage Lake, Jonpol Gold, and Williams Brook Gold, currently spanning over 32,000 ha of conducive gold exploration land package. The Triple Fault Gold project is situated around 60 km west of Bathurst and the property has been cross-cut with the paved road.

At present, Puma Exploration is targeting its fieldwork on the Williams Brook Gold property, which is its first priority.

This property includes chosen drill results of 1.0 g/t over 23 m, 2.1 g/t gold (Au) over 9.0 m, and 11.2 g/t over 2.8 m gold occurrences that grade up to 50.8 g/t Au, 109.0 g/t Au, and 38.9 g/t Au in bedrock, various gold soil anomalies, and highly anomalous till samples with gold grains of up to 508 occurring across a region of about 12 by 3 km.

Only limited drilling and exploration work has been performed in the region, which was mapped to be a portion of the Dunnage Zone hosting significant gold occurrences and gold deposits in siluro-Devonian rocks and deemed to be a growing gold exploration and development district.