Allegiant Gold Ltd. reported that it has struck an agreement with Anchor Minerals to alter the current option agreement on the 80 claims, as well as the start of a five-year, US$1.5 million work program at Goldfield West by Allegiant.

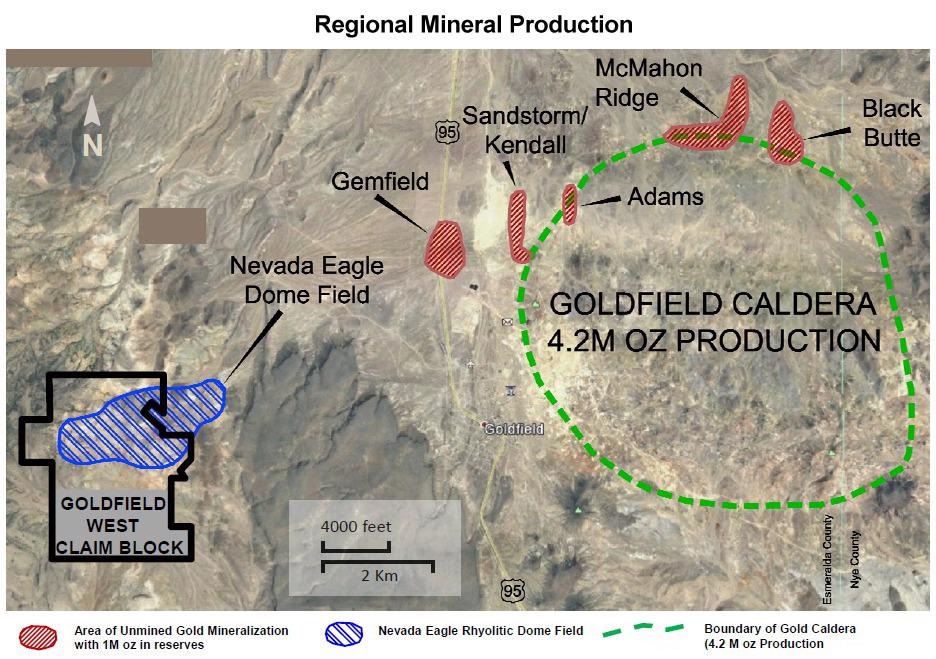

Goldfield Property Map. Image Credit: Allegiant Gold Ltd.

Goldfield Property Map. Image Credit: Allegiant Gold Ltd.

Allegiant Gold’s Goldfield West property comprises 185 unpatented claims (80 of which were optioned from Anchor Minerals) in the historic town of Goldfield. The Goldfield District Project (aka Gemfield Mine) was recently acquired by Centerra Gold for approximately US$206 million from Waterton Global Resources. The property is conveniently located near a major highway and has access to great infrastructure.

The original option agreement between Allegiant and Anchor on the 80 unpatented claims, signed on January 28, 2019, provided for Allegiant to pay advanced royalty payments during the term of the arrangement. The new deal suspends Anchor’s advanced royalty payments in exchange for a one-time lump-sum payment of US$140,000 to Anchor, which includes US$60,000 in cash and US$80,000 in Allegiant stock. After five years, a new advanced royalty payment of US$50,000 will begin, with an annual inflation adjustment. Allegiant has also committed to investing US$1.5 million in a five-year work program at Goldfield West.

We are very pleased to have reached an agreement with Anchor Minerals to amend the option agreement at Goldfield West. This new agreement provides material financial savings and the incentive for Allegiant to now conduct the required exploration program necessary to further advance the project.

Peter Gianulis, CEO, Allegiant Gold Ltd

Peter Gianulis added, “Goldfield West is currently in the middle of one of the most sought-after districts in Nevada and has always been one of the highest ranked projects in our portfolio. We look forward to providing our shareholders with additional information on our exploration efforts over the coming months.”

The closing of this deal is subject to TSX Venture Exchange’s final approval.