Consolidated Uranium has announced that drilling has started on its past-producing uranium projects in the US; Tony M Mine, Rim Uranium and Vanadium Mine, and Daneros Mine situated in south-eastern Utah.

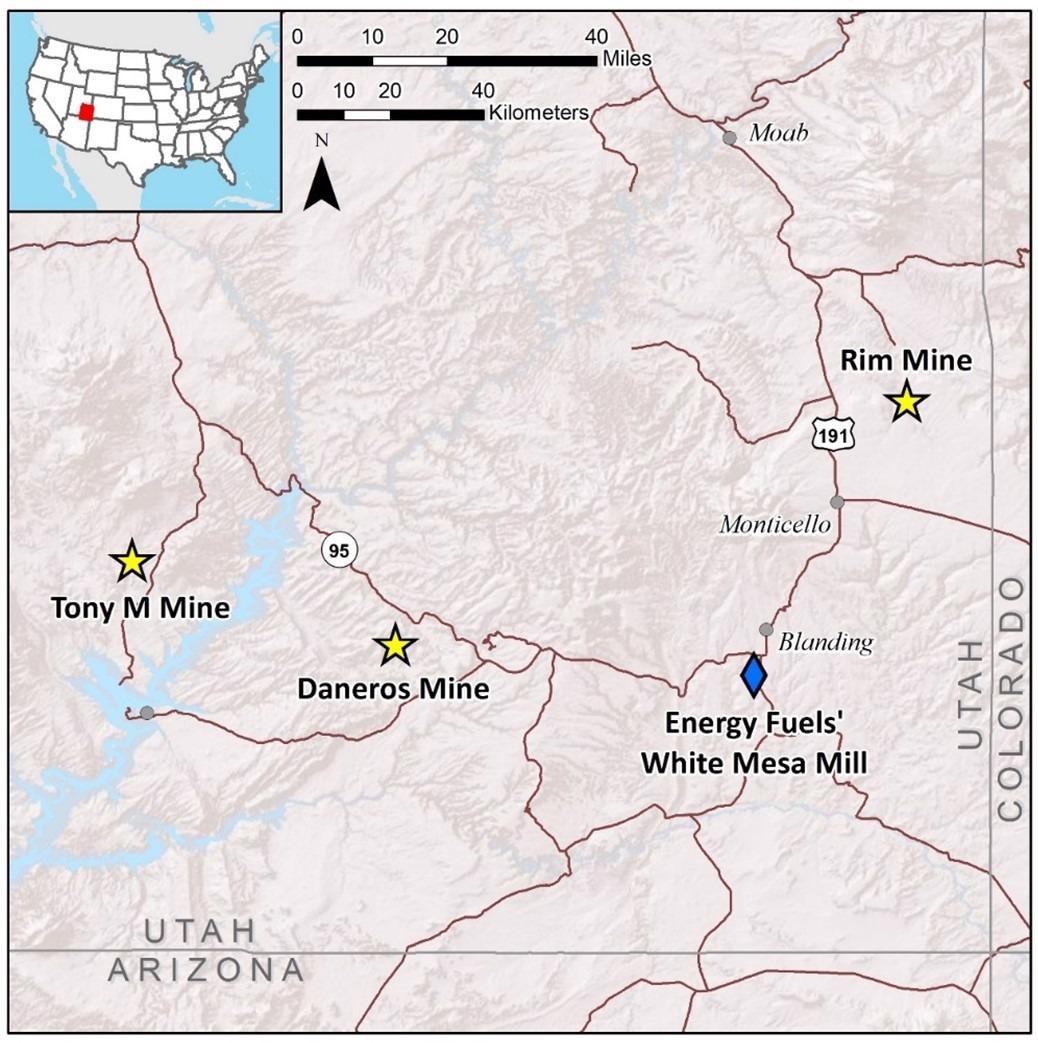

Location of CUR’s past-producing mines located in close proximity to the White Mesa Mill, the only operating conventional uranium mill in the US. Image Credit: Consolidated Uranium Inc.

Location of CUR’s past-producing mines located in close proximity to the White Mesa Mill, the only operating conventional uranium mill in the US. Image Credit: Consolidated Uranium Inc.

All three underground mines are completely developed and officially permitted, with production taking place most recently between 2006 and 2013. The mines are also exclusively situated close to the White Mesa Mill owned and operated by Energy Fuels, with whom Consolidated Uranium has a Toll Milling Agreement.

Consolidated Uranium has contracted DrillRite to carry out a scheduled 21,000 ft of surface drilling throughout all three projects, which will comprise traditional open hole rotary pre-collars with core “tails”. Borehole geophysical logging services will be carried out by Century Geophysical.

Highlights

Tony M Mine:

An 8-hole program encompassing 6,000 ft is currently in progress to confirm the historical exploration drill hole data set and enable the preparation of an existing mineral resource estimate.

Rim Uranium and Vanadium Mine:

A 15-hole program encompassing 10,000 ft will begin directly after the completion of the Daneros program and will concentrate on areas beyond the historic resource estimate.

Daneros Mine:

An 8-hole program encompassing 7,200 ft will start directly after the completion of the Tony M program and will concentrate on areas beyond the historic resource estimate.

Commencement of these drill programs represents an important step in demonstrating what we believe to be the tremendous inherent value and upside potential of our US uranium project portfolio. By verifying the historic mineral resource at Tony M and testing areas outside of the historic mineral resources at Daneros and Rim, we hope to position the Company to make a production decision in the second half of the year, subject to market conditions.

Philip Williams, Chairman and CEO, Consolidated Uranium

“We believe these projects are uniquely positioned to deliver new uranium production, in the strategically important domestic US market, in a short timeframe and for low additional capital investment. All three mines were in production during the uranium bull market of 2006 to 2010 with substantial capex spent by the previous operators. The projects are all fully permitted and expected to allow for rapid restart following a production decision,” Philip Williams added.

Further, our toll-milling agreement with Energy Fuels for processing of our material at the White Mesa Mill, positions CUR as the only conventional uranium developer that can both mine and have its material processed for the ultimate sale of uranium into the market in the near term. In our view, the attributes of these projects, when taken together, set CUR apart from its peers and we are poised to benefit from the expected continued strength in the uranium market.

Philip Williams, Chairman and CEO, Consolidated Uranium