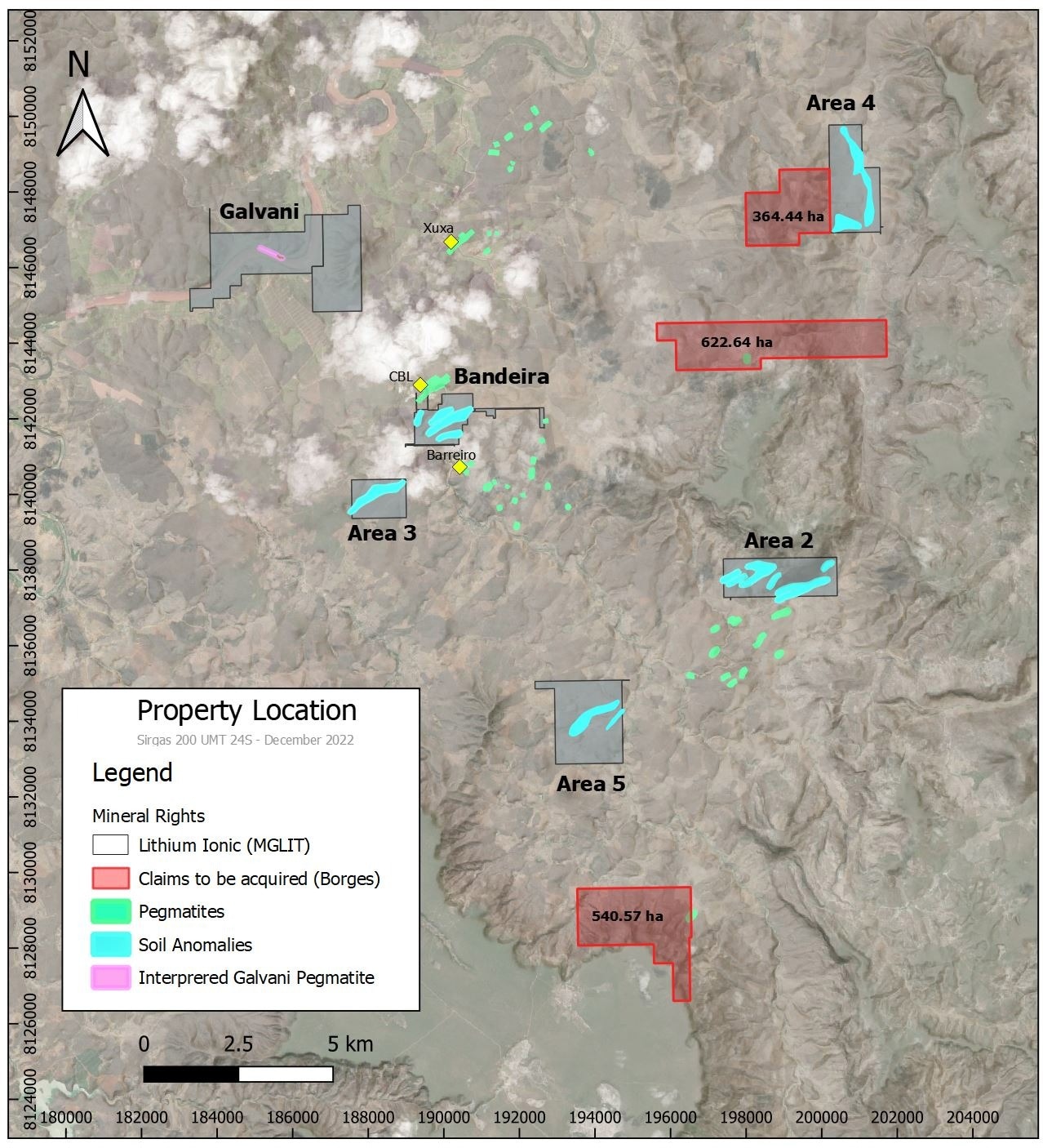

Lithium Ionic Corp. reported the signing of a binding asset purchase agreement with Mineraçao Borges Ltda. (Borges) and MGLIT Impediment’s Ltda., the Company’s wholly-owned subsidiary, under which the Company will acquire from Borges a 100% ownership interest in three mining claims totaling 1,527 hectares in Minas Gerais, Brazil.

Lithium Ionic Claims and Borges Claims to be Acquired. Image Credit: Lithium Ionic Corp.

The three Claims to be purchased comprise 1,527 hectares and are situated along trends with confirmed lithium deposits in the Itinga Pegmatite Field, including lithium producer CBL’s deposit and Sigma Lithium’s Xuxa and Barreiro deposits. A number of pegmatite occurrences have already been found, and they will be thoroughly explored right away with the goal of defining any prospective spodumene mineral resources.

The Borges claims will significantly add to our land holdings in this highly sought-after lithium district. We look forward to carrying out exploration on these prospective properties in the coming months.

Blake Hylands, CEO, Lithium Ionic Corp.

The Transaction

In order to execute the Transaction and in compliance with the terms of the Agreement, Lithium Ionic shall pay Borges:

- R$500,000 (about C$130,400) upon completion of the conveyance documents transmitting the Claims to MGLIT (Closing Date).

- R$15,000,000 (about C$3.9 million) contingent on the Company providing an independent NI 43-101 compliant mineral resource estimate on the Claims of at least 2 million tons with a Li2O concentration greater than 1.30% within 18 months of the Closing Date.

According to the TSX Venture Exchange’s (TSXV) regulations, the Transaction meets the criteria for “Exempt Transaction” status and is therefore considered an arm’s length transaction. In conjunction with the Transaction, Lithium Ionic is not paying any finder fees.