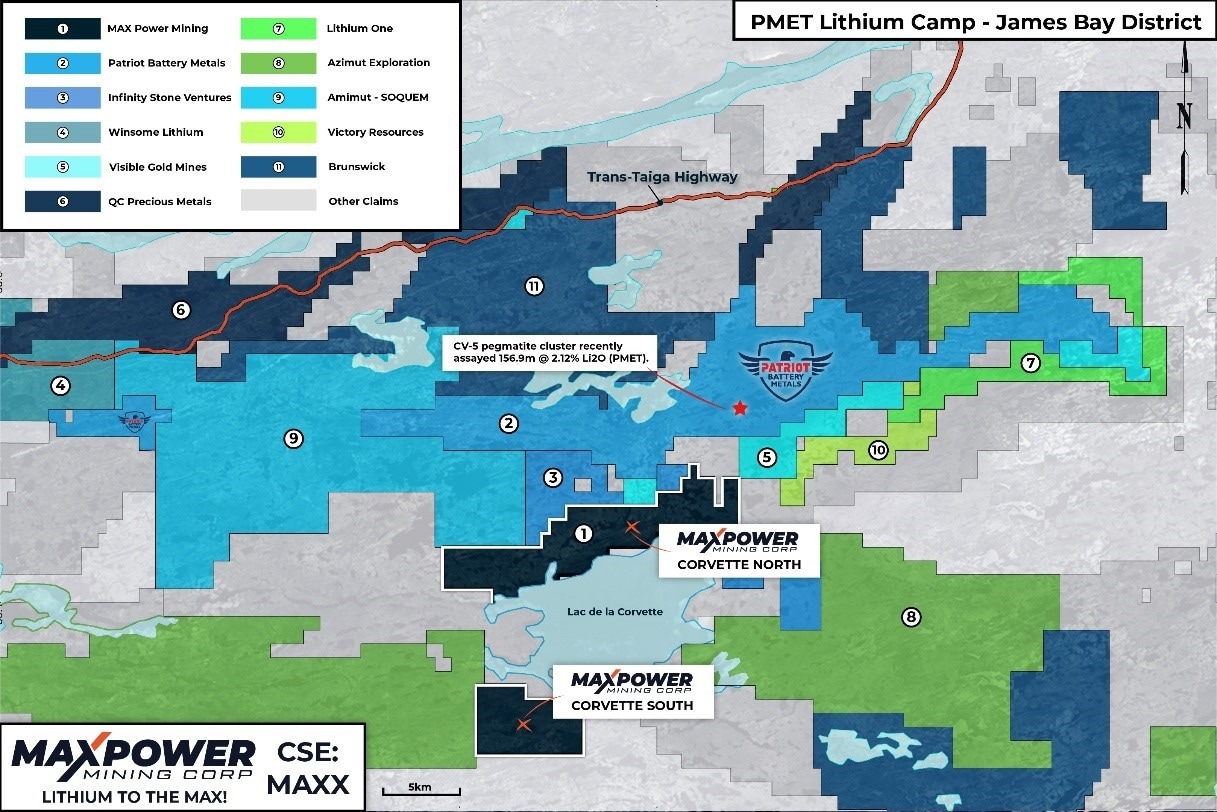

MAX Power Mining’s North American-focused lithium approach has led to the acquisition of approximately 100 km2 of claims close to the high-volume CV Lithium Trend and Patriot Battery Metals’ (PMETs) Corvette lithium discovery in the James Bay District of Quebec.

Property Location of MAX Power’s James Bay Lithium Projects. Image Credit: Max Power Mining Corp.

Highlights of the Acquisition Include:

- MAX Power has acquired a 100% interest in two under-investigated large claim blocks (Corvette Lake South and Corvette Lake North) close to PMET’s Corvette Property

- Government data, historical reports, and the latest reconnaissance have reported pegmatite existence on Corvette Lake North, about 5 km south of PMET’s CV5 pegmatite discovery where the most recent drilling yielded 156.9 m at 2.12% Li2O (drill hole CV22-083) as stated by PMET January 20th, 2023

- A large potential area covering 9,709 hectares with approximately 189 mineral claims

- Armed with more than $4 million in cash and a promising share structure, MAX Power is setting up a two-phase 2023 exploration program at its Corvette Camp properties with details to be presented shortly

- MAX Power currently is also assessing other possible opportunities in the Lithium sector

This important acquisition on favorable terms is a first major step for MAX Power as it positions itself in the rapidly expanding lithium sector. ‘Lithium to the MAX’ is our motto as we build out a dynamic lithium brand focused on Canada and the United States.

Rav Mlait, CEO, MAX Power Mining

Property Location Map and Bedrock Geology

Both properties are located along the shores of Corvette Lake and situated in the La Grande geological sub-province. The rocks are mostly Archaean in age. The MAX Power claims include 20 km of strike length of under-investigated sedimentary and intrusive rocks.

Corvette North has witnessed minimal historical mineral exploration, mainly for gold. Government data and historical reports document the presence of pegmatite on Corvette North. This same historical report indicates that pegmatites can be present within a range of rock types.

Management warns that mineralization hosted on neighboring and/or proximate properties is not essentially suggestive of the mineralization occurring on MAX Power’s properties.

Deal Terms

MAX Power signed a purchase and sale agreement for 100% of 189 mineral claims from Canadian Li Inc. (the “Vendor”) for consideration of 3,500,000 common shares (the “Consideration Shares”) of the Company and issue 1,000,000 warrants (“Consideration Warrants”).

The Consideration Warrants will be exercisable at $0.85 for 36 months from the date of issuance. Moreover, the Agreement specifies that the Vendor should be issued the Consideration Shares under the following timetable: (a) At the Closing Date, 1,500,000 Consideration Shares should be transferred to the Vendor from Max Power with a statutory requisite 4-month hold period; (b) 1,000,000 Consideration Shares should be made available for free trading 6 months from the Closing Date; and (c) 1,000,000 Consideration Shares should be available for free trading 12 months from the Closing Date.

All common shares dispensed in connection with the Agreement are conditional on a 4-month hold period under applicable Canadian securities laws. All terms are conditional on the authorization of the Canadian Securities Exchange.