Brascan Gold Inc. has signed an option agreement to purchase a 100% stake in the Brazil-Li Property, together with BHBC EXPLORAO MINERAL LTDA and RTB GEOLOGIA E MINERAO LTDA, two limited companies established and existing under Brazilian law.

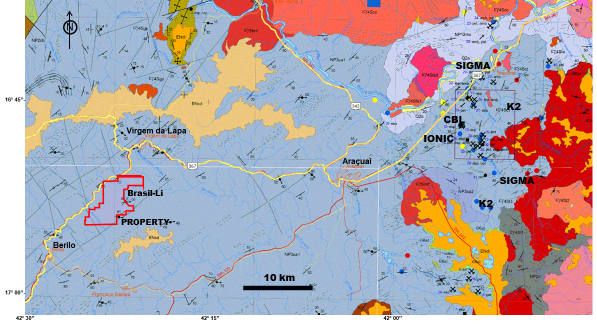

Claims map of the Brazil-Li Lithium Property in relation to CBL and SIGMA. Salinas Formation in blue, intruding granitoids in various shades of pink to red (After CPRM Geology Map, 2016). Image Credit: Brascan Gold Inc

The Grota do Cirilo property, owned by Sigma Lithium, is located on the largest lithium hard rock deposit in the Americas. The Brazil-Li Lithium Property is a 2,956.15-hectare mineral claim package made up of 1.5 contiguous claim blocks in the mining-friendly Minas Gerais State of Brazil.

In Brazil’s State of Minas Gerais, Sigma Lithium is situated in a newly developed, renowned hard rock Lithium District. The search for additional lithium resources is being actively pursued by Lithium Ionic (V.LTH), CBL, and Latin Resources.

When a new lithium deposit is explored, discovered, and developed in the district, the prospective valuations for the Brazil-Li property are indicated by Latin Resources (LRS A$275M mkt), Sigma Lithium (V.SGML C$4.1bn mkt), and Lithium Ionic (V:LTH C$288M mkt).

No qualified person employed by Brascan has independently validated the claimed occurrences, and the data is not necessarily representative of the mineralization on Brascan’s site, according to Brascan.

The property includes mica-quartz and quartz-mica schists from the Salinas Formation (unit 1), in addition to locally occurring metaconglomerates and micaceous quartzites (CPRM Geology map, 1:250:000 scale; 2016).

The Grota do Cirilo deposit of Sigma is located in the same unit of the Salinas Formation that CBL has been mining for spodumene lithium for approximately 30 years. To find viable exploration prospects, Brascan plans to immediately begin prospecting, sampling, comprehensive mapping, and multispectral analysis of satellite data.

Brascan’s option to purchase a 100% right, title, and ownership interest in the property over the course of three terms in exchange for 1,500,000 common shares, $100,000 in total cash payments, and a cumulative $200,000 in exploration costs.

BHBC will keep a 2% Net Smelter Royalty (or “NSR”), but the Company will have the option to pay $500,000 to acquire 1% of the NSR. The payment schedule and option periods (in Canadian dollars) are as follows:

- Option Period 1–February 13th, 2023 to September 30th, 2023

- $25,000 cash and issuance of 1,000,000 shares within 5 days of the term option agreement

- $100,000 in exploration expenditures before September 20th, 2023 and a second payment of $25,000 and issuance of an additional 500,000 shares before the end of Option Period 1

- Option Period 2–October 1st, 2023 to September 30th, 2024

- $100,000 in exploration expenditures before September 20th, 2024

- Option Period 3–October 1st, 2024 to September 30th, 2025

- $50,000 cash payment before September 20th, 2025

The Brazil-Li property acquired by Brascan totaling 30 sq. km. is well positioned in the Minas Gerais District and highly prospective for Lithium exploration and discovery. Brascan is now exploring for Lithium in two World Class Hard Rock Lithium jurisdictions in Canada and Brazil. Moreover, we are actively looking to acquire several more highly prospective lithium properties in both districts. Brascan is negotiating to acquire highly prospective lithium properties in the Jequitinonha Valley in Minas Gerais known as Lithium Valley.

Balbir Johal, Chief Executive Officer, Brascan Gold Inc.