Alamos Gold Inc. has reported that it has signed a legally binding agreement under which Alamos will utilize a court-approved plan of arrangement to acquire all of the issued and outstanding shares of Manitou Gold Inc.

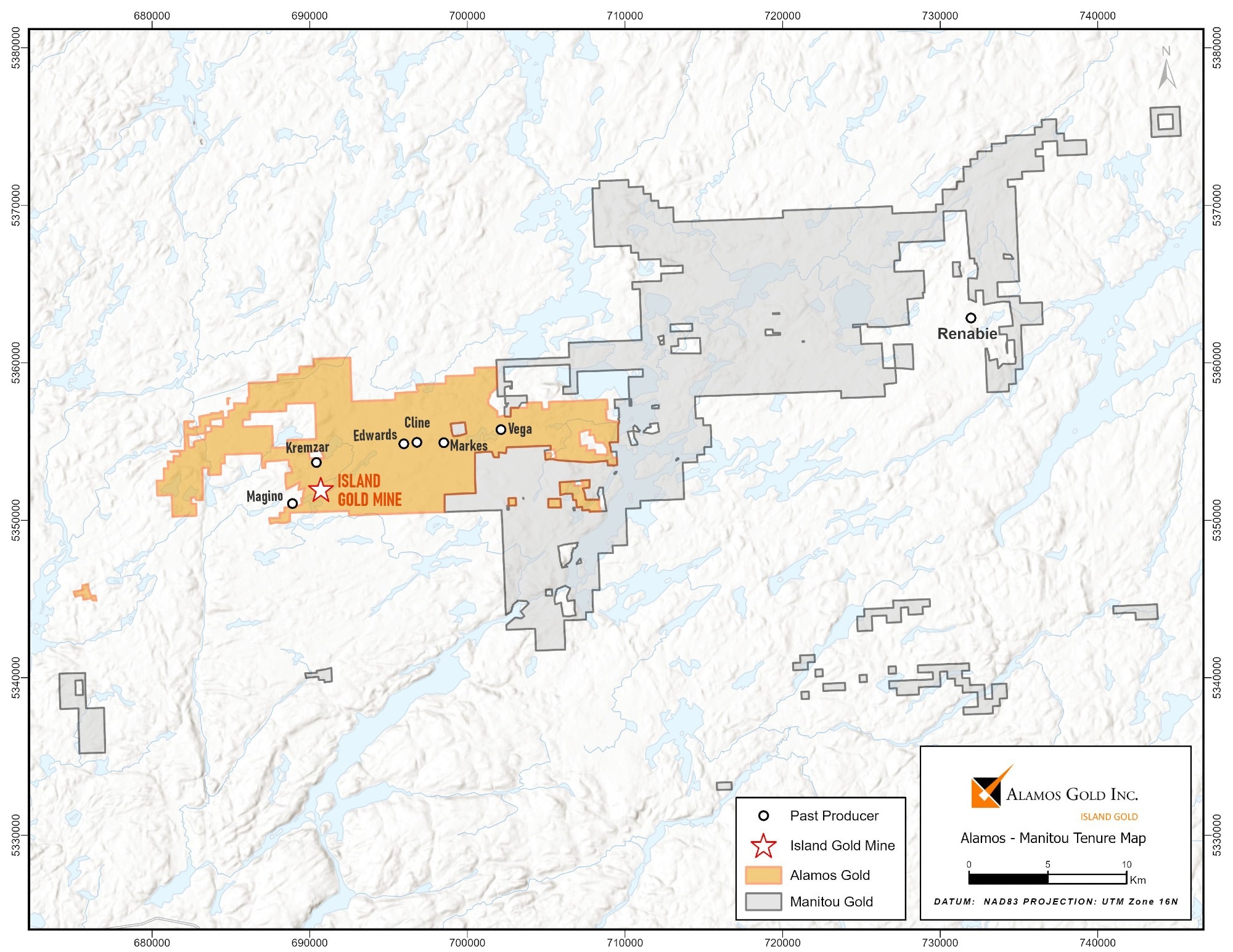

Alamos Gold and Manitou Gold Land Tenure Map. Image Credit: Alamos Gold Inc.

Alamos Gold and Manitou Gold Land Tenure Map. Image Credit: Alamos Gold Inc.

With the acquisition of the Goudreau Property, the transaction would strengthen Alamos’ regional property package around Island Gold and solidify its existing ownership of Manitou shares.

This covers 40,000 hectares next to and along a strike from the Island Gold Mine, offering enormous exploration potential throughout the Michipicoten Greenstone Belt, which is still comparatively underexplored. Alamos’ land package around the Island Gold Deposit is projected to expand by 267%, to 55,277 hectares.

A key control on gold mineralization in the Goudreau-Lochalsh section of the Michipicoten Greenstone Belt, the Goudreau Lake Deformation Zone, is extended along strike to the east through the acquisition.

The Island Gold Mine and the once-productive Renabie Gold Mine (aggregate production of 1.1 million ounces of gold from 1947–1991), the only two significant mines in the belt, will now share most of the mineral tenure with the expanded land package.

Six more belt-scale deformation zones, including the Cradle Lake-Emily Bay, Loch Lomond, Missinaibi, Baltimore, Easy Lake, and Renabie Deformation Zones, are also present on the Goudreau Property.

Alamos has created a methodical targeting and exploration strategy at the district scale for the region surrounding the Island Gold Mine. Now that the larger consolidated land package has been taken into account, this method can be employed to quickly develop and test new exploration prospects.

According to the provisions of the Agreement, Manitou shareholders will get 0.003525 of an Alamos’ common share for every Manitou share, which is worth C$0.05 based on the 20-day volume-weighted average trading price of Alamos’ shares on the Toronto Stock Exchange just before February 28th, 2023.

Based on the closing prices of Alamos and Manitou on February 27th, 2023, this represents a 95% premium over Alamos and an 88% premium over Manitou. Alamos now holds 65.2 million Manitou shares, around 19% of the company’s basic common shares, in circulation. Alamos anticipates issuing about 1.0 million shares for a total of C$14 million in consideration, excluding Alamos’ existing ownership of Manitou.

The Manitou management information circular will also go into further detail about the terms and circumstances of the Agreement.

The completion of the transaction is subject to customary conditions, such as court approvals, the affirmative votes of: (i) a majority of the Manitou common shares cast at a special meeting of shareholders, excluding shares held by Alamos and any other interested parties in the transaction; and (ii) at least 66 2/3% of the holders of Manitou common shares cast at a special meeting of shareholders, in addition to the receipt of all necessary regulatory and stock exchange approval.

A standard non-solicitation provision and right to match covenants are included in the Agreement.

The Transaction has received unanimous approval from the Alamos Board of Directors. Torys LLP is representing Alamos in legal matters. In conjunction with the deal, Manitou is receiving legal and financial advice from Fogler, Rubinoff LLP, and Hillcrest Merchant Partners, respectively.

Since our acquisition of Island Gold in 2017, much of our focus has been on near mine drilling where we have had tremendous success discovering more than four million ounces of high-grade Mineral Reserves and Resources. Through our acquisition of Manitou, we are more than tripling our land package along strike from Island Gold where we see excellent potential for additional high-grade discoveries across the prospective Michipicoten Greenstone Belt.

John A. McCluskey, President and Chief Executive Officer, Alamos Gold Inc.