Arya Resources Ltd. has signed a definitive agreement, effective February 28th, 2023, under which it will purchase the historic Dunlop nickel and copper deposit in northern Saskatchewan, Canada. The deposit is situated along provincial highway 102, 25 km north of the town of La Ronge.

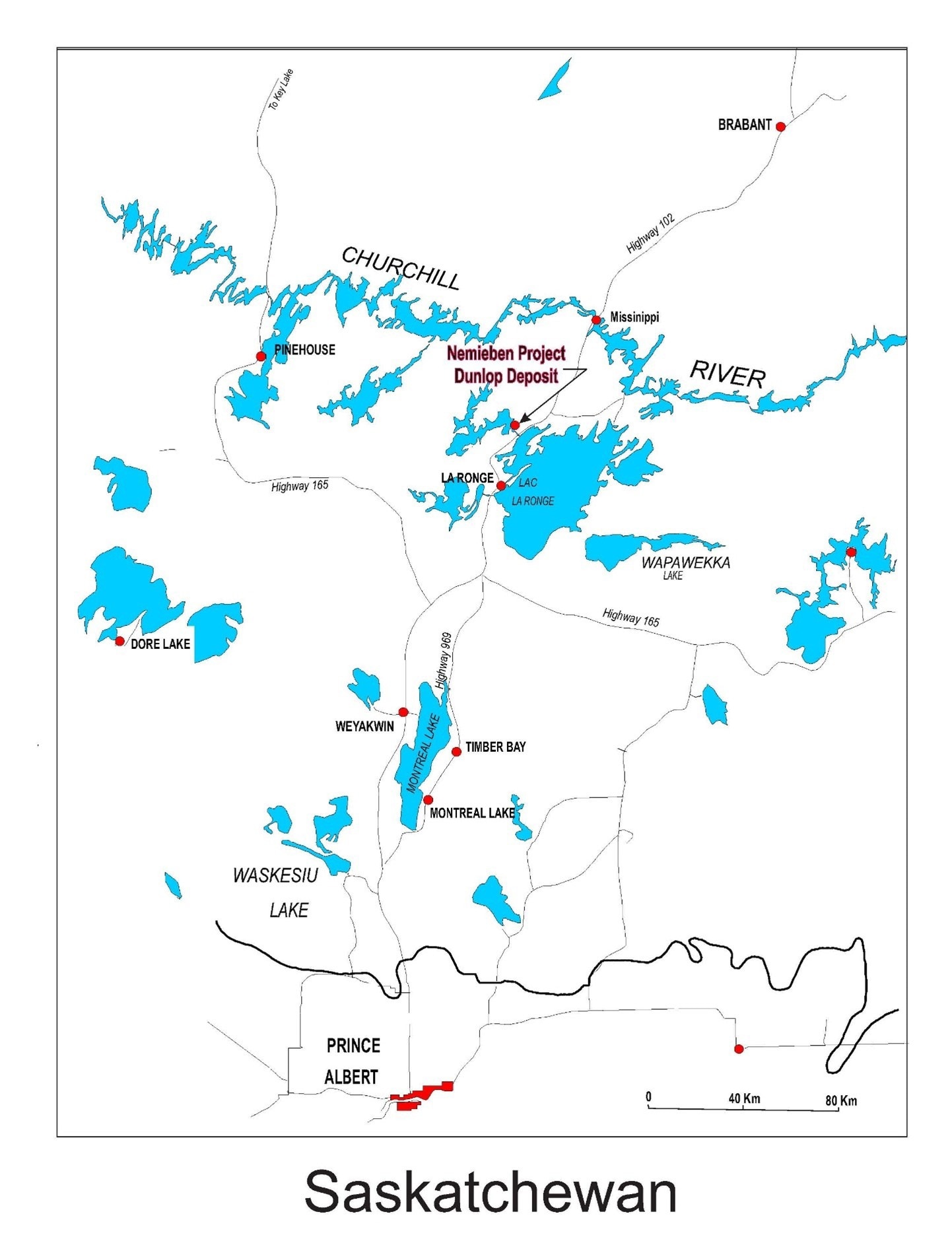

Dunlop Nickel, Copper Deposit Location. Image Credit: Arya Resources Ltd.

Dunlop Nickel, Copper Deposit Location. Image Credit: Arya Resources Ltd.

Arya Dunlop Project

- The Dunlop Ni-Cu historical deposit is reachable via a provincial highway that runs year-round.

- A historical deposit totaling 18.11 million tons of nickel and copper mineralization was found by previous drilling (16,700 m) between 1960 and 1980, of which 12.83 million tons were thought to be suitable for open-pit mining and the rest for underground mining. Grades varied from 0.15% Cu to 0.39% Cu and 0.55 Ni to 1.46% Ni, with values of up to 0.35% Cr and 0.15% Co.

- According to earlier economic assessments, the site should be mined at a rate of 900 tons per day, and the ore should be processed at the Anglo Rouyn mill. However, the mill was taken down and the plans to mine this deposit were abandoned after the Anglo Rouyn site ceased operations. Compared to today’s far higher costs of $4.03 US/lb for copper and $11.17 US/lb for nickel, the prices in 1966 were $0.84 US/lb and $0.45 US/lb, respectively. During the time, the economic assessments did not account for the values of precious metals like gold, silver, platinum, and palladium.

- Based on the CO2 sequestration in tailings, it could be possible to reduce the carbon footprint. This project has the potential to be Carbon Neutral or Net Carbon Negative.

- The Critical Mineral List 2021 for the USA and Canada includes nickel as a “critical mineral.” There is just one nickel mine in operation in the United States of America.

- Based on historical data and reports provided by the previous operators, the tonnage and grade are historical (non-43-101 compliant). The historical estimates are outdated and do not adhere to NI 43-101’s standards. They are pertinent to ongoing investigation and assessment and offer an indication of the assets’ potential.

Geology

The Dunlop deposit is located within the Nemeiben Lake ultramafic pluton, a small 1.6 km circular plug that is mainly made up of concentric layers of clinopyroxenite, websterite, and wehrlite in the Churchill Province of the Canadian Shield in central Saskatchewan. Insignificant amounts of dunite and gabbro can be found in the pluton’s northwest reaches.

Throughout the deposit, there are small amounts of disseminated primary magmatic pyrrhotite, pentlandite, chalcopyrite, magnetite, and chromite. In the northern outcrops, these amounts are more significant.

In serpentinized and uralitized peridotites and pyroxenites, a secondary assemblage that is considered to be low-grade Ni-Cu and consists of fine-grained oxides, sulfides, and native metals is present; this assemblage has not yet undergone a thorough analysis.

Property Agreement

According to the contract, the company can obtain a 100% interest in the Dunlop claims from North-Sask Ventures by investing a total of $250,000 over three years, issuing up to 600,000 shares, and making a cash payment of $25,000 and issuing the North-Sask 1 million shares following the completion of a 43-101 compliant resource estimate.

On the Dunlop claims, North-Sask holds a 3% NSR, of which 2.5% could be acquired for $2,000,000. The deal is regarded as arm’s length and is pending Exchange approval.

The Russian-Ukraine war impact on Russian Nickel-supply coupled with surging demand for battery-grade nickel-sulfide for energy storage uses, is creating a perfect storm for near-term nickel mines. We have even seen lately that automobile companies are financing or creating partnerships with Ni-Cu projects.”

Rasool Mohammad, Chief Executive Officer, Arya Resources Ltd.