A landmark option agreement has been signed between Sociedad Química y Minera de Chile SA and Mirasol Resources Ltd., increasing the size of the flagship Sobek Copper-Gold Project in the northeastern Chilean Vicuña Copper-Gold-Silver District. A significant driving reason for this consolidation was the 11,500-hectare SQM Property, which unites the Sobek Central and Sobek North blocks and extends the Sobek Project to the west and east.

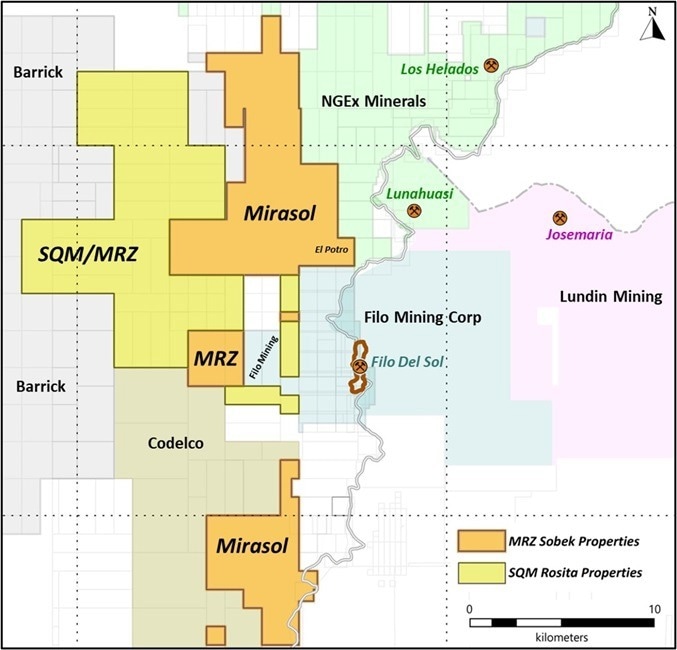

Vicuña District Claim Map - Expanded Sobek Property including the SQM Rosita Property. Image Credit: Mirasol Resources Ltd.

Vicuña District Claim Map - Expanded Sobek Property including the SQM Rosita Property. Image Credit: Mirasol Resources Ltd.

Mirasol now owns 22,640 hectares of land in the district, twice what it did before with the combination of properties. In the center of the Vicuña Copper-Gold area, the eastern part of the Rosita property places Mirasol 3 kilometers from the massive Filo Del Sol Project and the Sobek North block 3 kilometers from the Lunahuasi discovery.

The strategic expansion of the Sobek Project to include the sought after SQM Rosita property firmly secures Mirasol as a key player amongst industry-leading companies in the globally recognized Vicuña Copper-Gold district. The increase to our property size significantly increases the exploration potential and expands Sobek further to the east, just 3 kilometers west of the Filo del Sol Project.

Tim Heenan, President and Chief Executive Officer, Mirasol Resources Ltd.

He added, “The Rosita field program will commence immediately with a dedicated exploration team conducting mapping and geochemical sampling in parallel with a property wide stream sediment program to define areas of elevated interest. Now that the agreement has been signed, Mirasol can access the Rosita property to evaluate both AirMag and MT targets from Mirasol’s district wide proprietary geophysical database.”

High-Profile Vicuña Copper-Gold-Silver District

In 2016, Mirasol staked the Sobek Project before the high-grade feeder zone at the Filo del Sol gold-copper mine was discovered in 2021, based on favorable structural architecture and potential local geology. Situated along the same regional trend, the expanded Sobek Project is only 3 km west of the Filo del Sol deposit and 3 km southwest of the Lunahuasi (formerly Potro Cliffs) finding made by NGEx Mineral.

With strong north-northeast trending mineralized structural corridor and a deep-seated, northwest-trending trans-cordilleran lineament, Sobek is situated in an attractive geological setting. This similar structural arrangement is home to many metal deposits in Chile and Argentina’s southern Andes.

The expanded and combined Sobek Project includes a sizable block of 22,640 hectares of mining and exploration claims spread over four key areas: the Rosita Property in the Vicuña Copper-Gold-Silver District, the Central, North, and South blocks.

The well-known district contains several deposits close to Sobek, including the massive Eocene El Morro Porphyry copper-gold deposit 16 km to the west-southwest, the Filo del Sol mid-Miocene epithermal porphyry gold-copper deposit to the east, the recent NGEx discovery at Lunahuasi (formerly Potro Cliffs) to the northeast, the Josemaria copper-gold project 10 km to the east-northeast, the Los Helados Porphyry copper-gold breccia system 20 km to the northeast, and the massive Josemaria copper-gold project 10 km to the east-northeast.

Key Terms of the Agreement:

Mirasol has been given an exclusive right by SQM to acquire 80% of the Rosita Project for a period of six years, with a 2.0% NSR royalty attached.

- Incurring US$4 million in exploration expenditures

- Year 1: US$150,000

- Year 2: US$250,000

- Year 3: US$400,000

- Year 4: US$700,000

- Year 5: US$1.0 million

- Year 6: US$1.5 million

- Yearly option fee payments totaling US$3 million spread over six years

- At signing: US$30.000

- Year 1: US$45,000

- Year 2: US$75,000

- Year 3: US$200,000

- Year 4: US$350,000

- Year 5: US$700,000

- Year 6: US$1.6 million

After the option period expires, SQM will keep a 20% stake plus a 2% NSR in the Rosita Project, while Mirasol will have acquired an 80% interest. Following that, Mirasol and SQM will establish a Chilean Mining Contractual Company to oversee the Rosita Project, with Mirasol owning 80% of the shares and SQM owning 20%.

The significance of this landmark option agreement will be covered in a Webinar that will be hosted by Tim Heenan, President and CEO of Mirasol, at a later date.