Apr 20 2021

Canterra Minerals Corporation has announced that it has signed an option agreement with Sokoman Minerals Corp. to procure 100% of the East Alder gold project situated immediately northeast of its Wilding Gold Project in central Newfoundland.

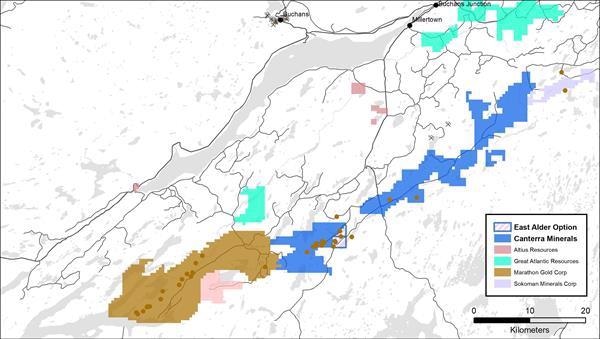

Current land position in Newfoundland with the addition of the East Alder Property Option. Image Credit: Canterra Minerals Corporation.

Current land position in Newfoundland with the addition of the East Alder Property Option. Image Credit: Canterra Minerals Corporation.

Highlights of East Alder Gold Project

- Rock samples obtained from a float span from 0.1 to 5.3 g/t Au and from trace quantities to 10.8% copper.

- A 2-km gold-in-soil trend with gold results is continuous with the gold-in-soil anomaly from the Wilding Gold Project of Canterra Minerals.

- Spans an additional 7.5 km2 of strike extent or 30 claims of the Valentine Lake Shear Zone that manages gold mineralization at the Wilding Gold Project and also the Valentine Lake project of Marathon Gold.

- Drilling permits are in place.

The East Alder Gold Project spans the northeastern extension of the same geological units hosting gold mineralization at the Wilding Gold Project of Canterra Minerals. This geology comprises the Silurian-aged Rogerson Lake conglomerates and Silurian felsic volcanic rocks known to host gold mineralization at the Wilding Gold Project.

This stratigraphy, as observed at the Wilding Gold Project in the Alder, Elm, and Red Ochre, offers prospective host environments for gold deposition in either disseminated or vein styles. Magnetic surveys finished on the East Alder Gold Project denote a structural setting analogous to the Wilding property and other gold showings located along the structural corridor and are represented via a trend of strong gold-in-soil anomalies that continue from the Wilding property of Canterra Minerals.

Preliminary reconnaissance work will be finished along with Canterra Minerals’ 2021 field program, aiming to detect, define, and possibly drill test targets on the East Alder gold project.

Adding this strategic block of claims extends our property position in the Rogerson Lake Belt and covers off the natural extension of gold mineralization found to date on our Wilding gold project. We look forward to adding this project into our extensive summer exploration program and adding the existing targets to our drill program.

Chris Pennimpede, President and CEO, Canterra Minerals Corporation

Summary Terms of the Agreement

Canterra Minerals can procure 100% of the East Alder gold project by issuing a total of 750,000 Canterra common shares and work commitments that total $600,000 over a period of four years. Sokoman Minerals will retain a net smelter return royalty of 1.0% on the East Alder gold project, and Canterra Minerals will have the right to purchase 0.5% of the royalty for $1,000,000.

The Option Agreement, inclusive of the issuance of Canterra common shares, will depend on approval by the TSX Venture Exchange. A statutory hold period will apply to the Canterra shares.

Summary of Option Payment

- A total of 250,000 common shares of Canterra Minerals will be issued to Sokoman Minerals within 10 days of the effective date and this would be subject to a six-month escrow period from the effective date after approval by the TSX Venture Exchange; on the exercise date, Sokoman Minerals will be granted a net smelter return royalty to purchase 0.5% for $1,000,000 on the terms and conditions defined in the Option Agreement.

- Property expenditures totaling $50,000 as well as 250,000 common shares will be issued to Sokoman Minerals on or before the first anniversary of the effective date.

- Property expenditures totaling $100,000 as well as 250,000 common shares will be issued to Sokoman Minerals on or before the second anniversary of the effective date.

- Property expenditures totaling $200,000 related to the East Alder gold project will be made on or before the third anniversary of the effective date.

- Property expenditures totaling $250,000 related to the East Alder gold project will be made on or before the fourth anniversary of the effective date.