Aug 29 2018

Liberty Gold Corp. recently reported the results from a large-diameter metallurgical core drilling program at the Goldstrike Project, the flagship of its three key gold projects situated in the prolific Great Basin of the United States. Goldstrike, located in southwestern Utah, is a past-producing oxide-heap leach gold mine that comprises a large, shallow, district-scale, Carlin-style gold system.

Liberty Gold continues to achieve its project improvement goals in 2018, beginning with a maiden resource estimate released on February 1st. On July 10th, 2018, Liberty Gold published a Preliminary Economic Assessment for Goldstrike (“PEA”)2, ratifying a low capital intensity, low operating cost, open-pit, run-of-mine, heap-leach operation, with a 7.5-year mine life and extremely attractive economics, including a post-tax Net Present Value (5% discount rate) of US$129.5 million, Initial Capex of US$113.2 million, and Internal Rate of Return of 29.4%.

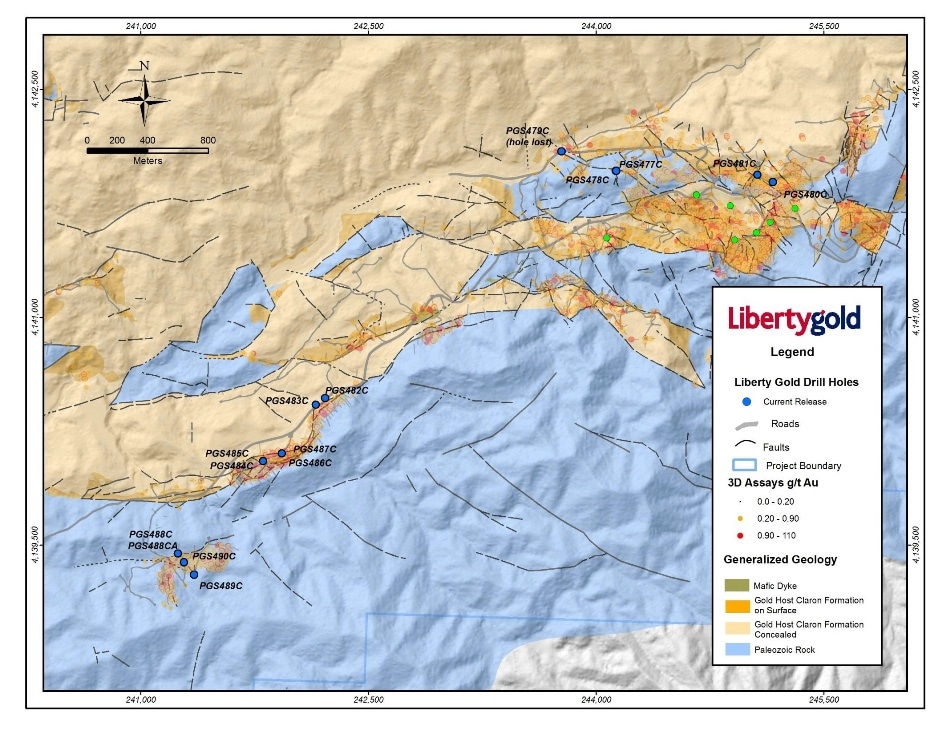

To aid in additional advancement of the Goldstrike Property, a large diameter (PQ) core drilling project was taken up so as to get the material required to approximately double the number of metallurgical column tests in the resource area from an existing 20 columns, mainly located in the Main Zone, to approximately 40, spread throughout the resource area. Fifteen PQ diamond core holes, totaling 1,357 m, were finished.

Drill Highlights Include:

- 0.59 g per ton gold (g/t Au) over 8.7 m and 0.79 g/t Au over 69.6 m including 2.46 g/t Au over 7.6 m in PGS483C

- 1.41 g/t Au over 36.9 m in PGS486C

- 0.71 g/t Au over 45.6 m in PGS487C

- 0.70 g/t Au over 47.4 m in PGS484C

- 0.67 g/t Au over 33.5 m, including 1.45 g/t Au over 9.8 m in PGS478C

- 0.33 g/t Au over 36.7 m and 0.41 g/t Au over 18.3 m in PGS488CA

Key Points

- Liberty Gold continues to perform and deliver on its commitment to advance the Goldstrike Project through extra metallurgical drilling all over the current resource area

- The drill holes also infill targets in the Dip Slope and Western resource zones, and results match earlier RC drilling from these areas

- Composite selection for column tests is ongoing, with final results anticipated in the first half of 2019

Besides the core drilling program, a reverse circulation program is presently ongoing with two drills. Thus far, more than 16,000 m have been drilled, with a low all-in cost for RC drilling of just US$55/m, well below the industry average. The program is concentrated on 1) infill and expansion of the resource; 2) testing of the historic heap-leach, stockpile and waste dump areas that are mainly located within the PEA pit and counted as waste in the model; and 3) testing of new targets property-wide. An amendment to the present Plan of Operations to grant access to an extra >878 acres in and next to the resource area is anticipated in the final quarter of 2018.

Goldstrike is situated in the eastern Great Basin, directly adjacent to the Utah/Nevada border, and is a Carlin-style gold system, comparable in many ways to the prolific deposits located along Nevada’s Carlin trend. Similar to Kinsley Mountain and Newmont’s Long Canyon deposit, Goldstrike characterizes part of a growing number of Carlin-style gold systems situated off the main Carlin and Cortez trends in underexplored areas of the Great Basin. The historic Goldstrike Mine functioned from 1988 to 1994, with 209,000 ounces of gold mined from 12 shallow pits, at an average grade of 1.2 g/t Au and an average recovery of about 75%.

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the data contained in the release is accurate. Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are described as drilled thicknesses.

True widths of the mineralized intervals differ between 30 and 100% of the reported lengths because of varying drill hole orientations, but are normally in the range of 60 to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30-gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and accomplished with a gravimetric finish. For these samples, the gravimetric data were made use of in calculating gold intersections. For any samples assaying over 0.200 ppm an extra cyanide leach analysis is performed where the sample is treated with a 0.25% NaCN solution and rolled for an hour.

An aliquot of the final leach solution is then centrifuged and tested by AAS. QA/QC for all drill samples comprises the insertion and continual checking of several standards and blanks into the sample stream, and the collection of duplicate samples at unplanned intervals within each batch. Selected holes are also analyzed for a 51-multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.