MTM Critical Metals Limited (“MTM”) has achieved a breakthrough in sustainable metal recovery, unlocking ultra-high-grade gold (551 g/t) and other valuable metals from electronic waste (E-Waste), alongside securing transformative 5-year supply agreement with Dynamic Lifecycle Innovations, Inc. (“Dynamic”), a leading U.S. recycling company.

Figure 1. Photo of (L) original E-Waste printed circuit board waste & (R) metal rich char (E-Waste with plastics removed by separate process). Image Credit: MTM Critical Metals Limited

Figure 1. Photo of (L) original E-Waste printed circuit board waste & (R) metal rich char (E-Waste with plastics removed by separate process). Image Credit: MTM Critical Metals Limited

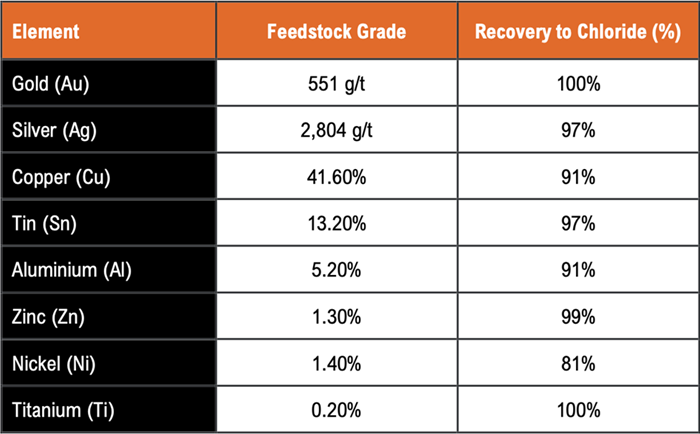

Leveraging the Company’s proprietary Flash Joule Heating (FJH) technology, exceptional recovery rates were achieved from ultra-high-grade E-Waste feedstock, including 100% gold recovery at 551 g/t and 97% silver recovery at 2,804 g/t. The processed feedstock was a metal-rich e-waste residue supplied by a U.S. recycling partner specializing in converting plastics to syngas, with whom commercial discussions are ongoing. These results, combined with a secured supply chain, position MTM as a leader in the $250 billion E-Waste recycling market projected for 2032.

Founded in 2001, Dynamic Lifecycle Innovations Inc. is a leading provider of electronics recycling and IT asset disposition (ITAD) services in the United States, specializing in secure data destruction, responsible e-waste recycling, and refurbished electronics. The company is headquartered in Onalaska, Wisconsin.

Metal Recovery Test Results

- Ultra-High-Value Printed Circuit Board (PCB) Feedstock: Gold & Silver concentrations of 551 g/t and 2,804 g/t respectively, copper at 42%, substantially exceed traditional mining grades and highlight economic potential of E-Scrap.

- Outstanding Recoveries: Achieved over 95% recovery for gold & titanium, with silver, tin, & zinc exceeding 90% into water-soluble metal chlorides using Flash Joule Heating (FJH) technology. Results verified by multiple test runs.

- High-Value Feedstock: E-Scrap tested originated from end-of-life U.S. electronics, including cell phones, laptops, data processing servers, and telecommunications equipment.

- Single-step, acid-free process eliminates toxic waste and converts metal-rich waste into water-soluble metal chlorides—without prolonged heating or acids used in traditional methods like smelting.

Long-Term E-waste Feedstock Supply Agreement

- Supply Chain Secured: Signed Letter of Intent (LOI) for five-year e-waste supply agreement with leading U.S.-based recycling firm Dynamic Lifcycle Innovations, including significant penalties for non-performance regarding the 700 tonnes per annum (TPA) of E-scrap, ensuring a consistent supply (target ~800 t/year with 700 t minimum).

- Long Term Supply Agreement with one of the largest recyclers in the U.S., this secures long-term feedstock for MTM’s U.S. operations, de-risking commercial rollout and enhancing credibility with offtake partners. Agreement to become binding at the signing of the formal supply contract, anticipated over the coming weeks.

- Department of Defence (DoD) Interest: Recent meetings with the U.S. Department of Defence highlighted strategic interest in MTM’s sustainable, domestic E-Waste recovery process for recovering precious and critical materials.

- Significant Market Opportunity: Global E-Waste generation reached 62 Mt in 2022, projected to rise to 82 Mt by 2030, with a recycling market valued at $250 billion by 2032 (Allied Market Research, 2023; Baldé et al., 2024).

MTM Managing Director & CEO, Michael Walshe, commented: “Securing this supply agreement marks a pivotal milestone in MTM’s commercialization journey. Reliable feedstock is fundamental to any recycling operation, and this agreement ensure a scalable, long-term supply. Combined with our breakthrough gold recovery results, MTM now has both the technology and supply chain to underpin a robust commercial rollout and strategic partnerships. Together, these advancements significantly de-risk our business model and pave the way for additional strategic partnerships in the U.S. and globally”.

The tested feedstock, derived from U.S.-sourced printed circuit boards (PCBs), revealed significantly high metal content, particularly in precious metals. Note: This tested material was provided by a supplier other than Dynamic (the new feedstock supply partner discussed). Key results include:

Table 1. Summary of Testwork Results

These grades are remarkable when compared to traditional mining operations. For context, typical gold ore grades range from 1–5 g/t (Hagelüken, 2006), meaning this processed E-Waste feedstock contains over 100 times more gold per tonne than conventional ore. Similarly, silver at 2,804 g/t far exceeds typical mined ore concentrations, which are often below 1,000 g/t (Baldé et al., 2024). This high-grade feedstock, combined with near-perfect recovery rates for precious metals (100% for gold, 97% for silver), highlights the immense economic potential of E-Waste as a resource.

Figure 2. E-Waste Process Flow Diagram for Metal Recovery. Image Credit: MTM Critical Metals Limited

The e-waste material tested in this study consisted of a metal-rich char, produced via a separate upstream process that removed the plastic fraction by converting it into synthesis gas (syngas). This left behind a concentrated, carbonaceous residue enriched in metals, which was then processed by MTM using its FJH technology. In addition to this material, MTM has also conducted prior testwork on unprocessed, raw e-waste (including whole printed circuit boards), with similarly encouraging recovery results—demonstrating the flexibility and robustness of the process across different feedstocks.

Economic and Environmental Significance

The recovery of metals from E-Waste not only addresses a pressing environmental challenge but also creates substantial economic value. Globally, E-Waste contains an estimated $62 billion worth of recoverable materials annually, yet only ~15% was recycled in 2022 (Baldé et al., 2024). By recovering high-value metals like gold (current market price ~ US$ 100,000/kg) and silver (~US$ 1,000/kg), MTM can generate significant revenue while reducing reliance on energy-intensive mining.

Environmentally, the FJH process offers a cleaner alternative to traditional acid-based or pyrometallurgical methods, using up to 500 times less energy and avoiding toxic solvents (Tour et al., 2021). This aligns with global sustainability goals and supports a circular economy by repurposing end-of-life electronics into valuable raw materials.

E-Waste Supply Agreement – Key Commercial Terms

As part of MTM’s strategy to commercialize its technology, the Company’s wholly-owned U.S. subsidiary Flash Metals USA, Inc. has executed a Letter of Intent (LOI) with Dynamic Lifecycle Innovation Inc., a U.S.-based recycling partner. This LOI outlines the principal terms for a long-term e-waste supply agreement which will become binding at the signing of the supply agreement, securing a consistent supply of high-grade feedstock to support MTM’s planned operations and scale-up in the United States. The key commercial terms outlined in the LOI with Dynamic Lifecycle Innovations. are as follows:

- Initial Term: Five (5) years, commencing Q4 2025.

- Renewal Option: Extendable for additional 5-year terms by mutual written agreement. (Either party must give at least 180 days’ notice prior to the end of the term if they elect not to renew.)

- Volume Commitment: Target annual volume of ~800 tonnes of PCB-rich e-waste material, with a firm Minimum Annual Volume commitment of 700 tonnes. This equates to an average of approximately 65–70 tonnes per month. Dynamic Lifecycle Innovations will supply, and MTM will accept, at least the minimum volume each year. Actual monthly shipments may vary, but any significant supply shortfall measured on a quarterly basis below 180 tons per quarter will trigger significant financial penalties.

- Feedstock Type and Grade: High-Grade, Medium-Grade and Low Grade printed circuit board (PCB) rich electronic waste, containing recoverable precious, base, and critical metals. (Grade classifications are based on metal content thresholds defined in the agreement’s specifications.) The materials are to be provided in sorted, bulk form (e.g. sorted PCB scrap) and must meet agreed quality standards (minimal unrelated debris, no hazardous exclusions outside typical e-waste).

- Pricing Structure: Market-indexed pricing linked to the Scrap Register (or an equivalent) monthly average price for electronic scrap. The price paid per shipment will be adjusted based on the actual assay of recoverable metals in that shipment. In practice, an initial reference price is set for High-Grade, Medium-Grade, and Low-Grade material, and after MTM processes each batch, the final payment is adjusted up or down according to the verified metal content (assay results) to reflect the true grade. This ensures MTM only pays for the metal value received, and Dynamic Lifecycle Innovations. is rewarded for higher-grade deliveries.

- Non-Exclusivity: The supply arrangement is exclusive for the first 700 tons per year of e-scrap, meaning Dynamic LifeCycle Innovations will continue to sell similar e-waste materials to other parties other than the 700 TPS to MTM, and MTM may source from other suppliers above the 700 TPA. This provision gives MTM access to incremental feedstocks in the market supporting potential future expansion.

- Renewal & Termination Conditions: After the initial 5-year term, the agreement can be renewed as noted above. Either party may terminate earlier for cause if the other party materially breaches the agreement and fails to cure the breach within 30 days of notice. Additionally, MTM (the Buyer) has the right to terminate the agreement without penalty if Dynamic Lifecycle Innovations. (the Supplier) fails to deliver at least 100% of the agreed Minimum Annual Volume for two consecutive years, after giving 60 days’ notice and opportunity to cure the shortfall. Standard termination rights for events of force majeure and prolonged inability to supply are also included.

- This Long Term LOI serves as a framework for the definitive supply agreement, reflecting the mutual intentions of both parties to formalise the outlined terms. While the LOI is detailed in nature, the final agreement remains subject to the negotiation and execution of definitive documentation.

Strategic Importance: Securing this long-term feedstock supply is a critical step in MTM’s path to commercialization. Consistent input supply de-risks the operational scale-up by ensuring the planned FJH processing facilities have sufficient high-value material to operate continuously. This underpins MTM’s financial model – a reliable tonnage of feedstock translates to a predictable throughput of metals for sale, supporting revenue forecasts and growth targets.

Next Steps

- Pilot-Scale Testing: Expand testing on diverse E-Waste streams to validate scalability.

- Commercial Partnerships: Finalise agreements in the U.S., Japan, Taiwan, and Europe to establish regional operations.

- FJH Demonstration Plant: Site selection in Texas, USA, targeting operational status by the end of Q4 2025.