Sep 13 2019

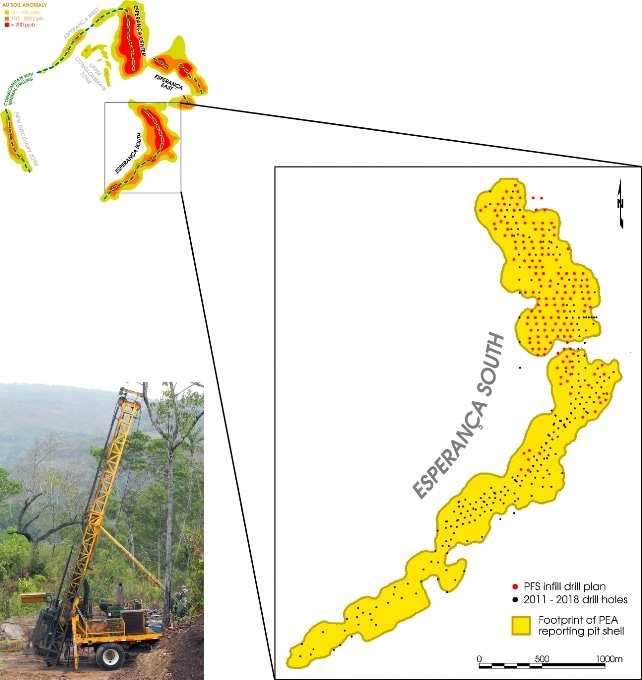

TriStar Gold Inc. reported that infill drilling has commenced at Castelo de Sonhos. This campaign concentrates on Esperança South, with about 200 holes (20,000 to 25,000 m) that aim to boost confidence in resource estimates which will act as the foundation for the pre-feasibility study (PFS) scheduled for completion by the end of 2020.

Pre-feasibility drill plan. (Tristar Gold)

Pre-feasibility drill plan. (Tristar Gold)

The first reverse circulation rig started drilling recently; a second will commence in the following weeks.

With Royal Gold’s recent investment, TriStar is funded through the completion of this study; our team is now solely focused on aggressively moving this amazing project forward. The effort over the next 12 months at Castelo de Sonhos is all about increasing knowledge and reducing risk to expose the full value of this project in what looks like a buoyant gold market.

Nick Appleyard, President and CEO, TriStar Gold Inc.

The conclusion of this drilling campaign will bring the drill hole spacing in Esperança South to 50 m. In all the earlier resource estimation studies for the CDS Project, 50-m spacing has been sufficient for the classification of Indicated Mineral Resources. Substantial extra resource potential exists beyond Esperança South, in areas where 100-m drilling has already defined Inferred Mineral Resources and in areas of outcropping mineralized conglomerate that are still not drilled.

An optical televiewer (OTV) will be employed to capture an image of the inside of the holes; TriStar’s earlier use of OTV proves that the superior quality images offer outstanding data on lithologies and sedimentary structures, and serve as the perfect foundation for precise measurements of the orientations of the bedding and structures that regulate gold mineralization.

TriStar is also pleased to report that CSAGlobal of Toronto Canada has been chosen as the lead pre-feasibility consultant.

Highpoints of the Preliminary Economic Assessment, reported on November 16th, 2018 are:

- Internal rate of return, pre-tax of 51%, post-tax of 43% (using a gold price of $1250 per oz.)

- Life-of-mine recoverable gold of 1.1 million oz.

- All in sustaining cost of $687/oz.

Last year’s PEA is introductory in nature and comprises Inferred Mineral Resources that are considered too theoretical geologically to have the economic considerations applied to them that would allow them to be classified as Mineral Reserves. It is not certain whether the economic results stated in the PEA will be attained. Mineral Resources that are not Mineral Reserves do not have confirmed economic viability.