Rockridge Resources Ltd. has disclosed that it has successfully closed a non-brokered flow-through private placement financing (the Private Placement) for total gross proceeds of $472,000. At the price of CAD 0.05 per flow-through unit (the FT Units), the company issued 9,450,000 of them.

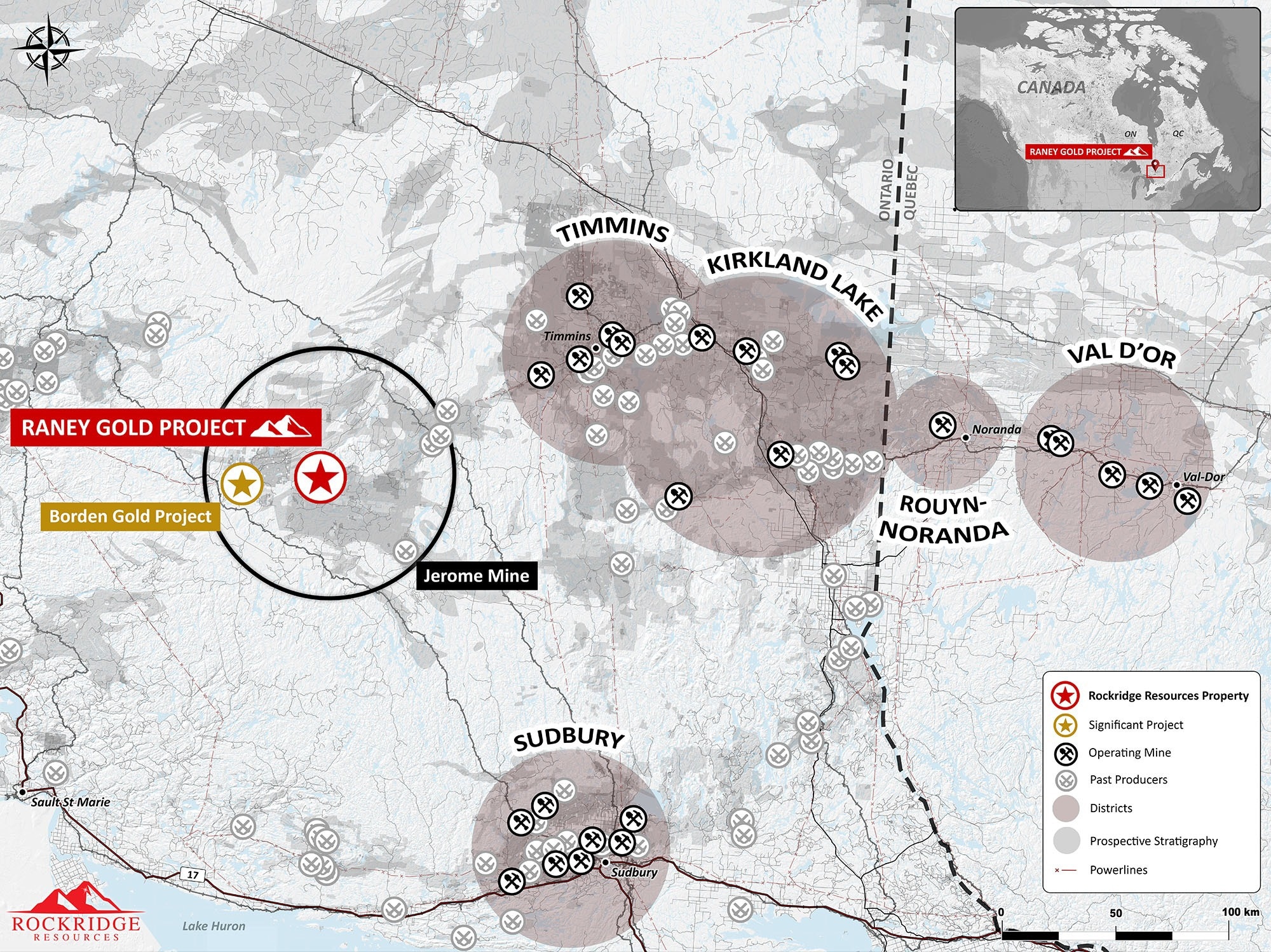

Raney Gold Project Regional Geology Map. Image Credit: Rockridge Resources Ltd.

Each FT Unit is made up of one common share and one warrant, with each warrant entitling the holder to buy one non-flow-through common share for 36 months for CAD 0.07.

A total of 651,000 finder’s warrants, each entitling the holder to acquire one common share for 36 months at a price of CAD 0.07, have also been granted by the company to arm’s-length parties, for a total finder’s fee payment of $32,550.

The company hopes to use the flow-through revenues from this private placement for drilling programs at its Raney Gold Project, located southwest of Timmins, Ontario, in addition to exploration activities.

Rockridge has obtained funding and authorization for this drilling program, which calls for a minimum of 2,500 m to be drilled in 10 to 12 diamond drill holes, with room for expansion.

Previous drilling and historical geophysics have indicated numerous significant structures that could possibly host new high-grade gold zones, including hole RAN-20-06, which yielded 27.9 g/t Au over 6.0 m at about 100 m vertical depth.

This proposed drill program will make use of all available exploration information to investigate the strike potential and depth continuity of high-grade gold mineralization encountered in previous holes.

The company intends to explore the Main Raney Gold Zone’s eastward and westward continuity in particular since there are nearby geophysical anomalies that have not yet been drill tested there. On the drilling program, further information will be released soon.